Boeing 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

We have insurance coverage to respond to this

arbitration request and have notified responsible insurers.

On May 26, 2006, a group of these insurers filed a declaratory

judgment action in the Circuit Court of Cook County asserting

certain defenses to coverage and requesting a declaration of

their obligation under Boeing’s insurance and reinsurance poli-

cies relating to the Thuraya ICC arbitration. We believe the

insurers’ position lacks merit and intend to vigorously litigate

the coverage issue.

BSSI/Telesat Canada

On November 9, 2006, Telesat Canada and its insurers

served BSSI with an arbitration demand alleging breach of

contract, gross negligence, and willful misconduct in connection

with the constructive total loss of Anik F1, a model 702 satellite

manufactured by BSSI. Telesat and its insurers seek over $385

in damages and $10 in lost profits. On December 1, 2006, we

filed an action in the Ontario Superior Court of Justice, Ottawa,

Canada, to enjoin the arbitration. We believe that the claims

asserted by Telesat and its insurers lack merit, but we have

notified our insurance carriers of the demand.

BSSI/Superbird-6 Litigation

On December 1, 2006, BSSI was served with an arbitration

demand in subrogation brought by insurers for Space

Communications Corporation alleging breach of warranty,

breach of contract and gross negligence relating to the

Superbird-6 communications satellite, which suffered a low

perigee event shortly after launch in April 2004. The low orbit

allegedly damaged the satellite, and a subsequent decision to

de-orbit the satellite was made less than 12 months after

launch. The model 601 satellite was manufactured by BSSI and

delivered for launch by International Launch Services on an

Atlas launch vehicle. The insurers seek to recover in excess of

$215 from BSSI. We believe the insurers’ claims lack merit and

intend to vigorously defend against them.

Note 23 – Other Commitments and Contingencies

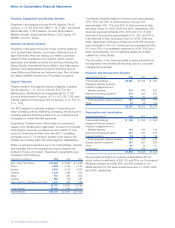

As of December 31, 2006 and 2005 we had $86,254 and

$58,532 of production related purchase obligations not

recorded on the Consolidated Statement of Financial Position.

Such obligations include agreements for production goods,

tooling costs, electricity and natural gas contracts, property,

plant and equipment, inventory procurement contracts, and

other miscellaneous production related obligations. As of

December 31, 2006, the amounts of production related

purchase obligations for each of the next five years were as

follows: $34,926 in 2007, $20,988 in 2008, $14,088 in 2009,

$7,817 in 2010, and $4,123 in 2011.

Financing commitments related to aircraft on order, including

options, totaled $10,164 and $13,496 as of December 31, 2006

and 2005. We anticipate that not all of these commitments will

be utilized and that we will be able to arrange for third-party

investors to assume a portion of the remaining commitments,

if necessary.

In conjunction with signing a definitive agreement for the sale of

new aircraft (Sale Aircraft), we have entered into specified-price

trade-in commitments with certain customers that give them

the right to trade in their used aircraft for the purchase of Sale

Aircraft. The total contractual trade-in value was $1,162 and

$1,395 as of December 31, 2006 and 2005. Based on the best

market information available at the time, it was probable that

we would be obligated to perform on trade-in commitments

with net amounts payable to customers totaling $19 and $72

as of December 31, 2006 and 2005. The estimated fair value of

trade-in aircraft related to probable contractual trade-in commit-

ments was $19 and $50 as of December 31, 2006 and 2005.

Probable losses of $22 have been charged to Cost of products

and were included in Accounts payable and other liabilities as

of December 31, 2005. These trade-in commitment agree-

ments have expiration dates from 2008 through 2015.

As of December 31, 2006 and 2005, future lease commitments

on aircraft and other commitments not recorded on the

Consolidated Statements of Financial Position totaled $323 and

$371. These lease commitments extend through 2020. As of

December 31, 2006, the future lease commitments on aircraft

for each of the next five years were as follows: $44 in 2007,

$47 in 2008, $25 in 2009, $20 in 2010, and $18 in 2011. Our

intent is to recover these lease commitments through sublease

arrangements. As of December 31, 2006 and 2005, Accounts

payable and other liabilities included $65 and $76 attributable

to adverse commitments under these lease arrangements.

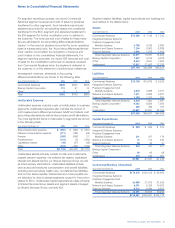

We and Lockheed have agreed to make available to ULA a

line of credit in the amount of up to $200 each as may be

necessary from time to time to support ULA’s Expendable

Launch Vehicle business during the five year period following

December 1, 2006. ULA did not request any funds under the

line of credit as of December 31, 2006.

McDonnell Douglas Corporation insured its executives with

Company Owned Life Insurance (COLI), which are life insurance

policies with a cash surrender value. Although we do not

use COLI currently, these obligations from the merger with

McDonnell Douglas are still a commitment at this time. We

have loans in place to cover costs paid or incurred to carry

the underlying life insurance policies. As of December 31, 2006

and 2005, the cash surrender value was $288 and $259 and

the total loans were $279 and $252. As we have the right to

offset the loans against the cash surrender value of the policies,

we present the net asset in Other assets on the Consolidated

Statements of Financial Position as of December 31, 2006

and 2005.

The costs incurred and expected to be incurred in connection

with environmental remediation activities have not had, and are

not expected to have, a material adverse effect on us. With

respect to results of operations, related charges have averaged

less than 1% of historical annual revenues. Although not

considered probable or reasonably estimable at this time, it is

reasonably possible that we may incur additional remediation

charges because of regulatory complexities and the risk of