Boeing 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 61

Notes to Consolidated Financial Statements

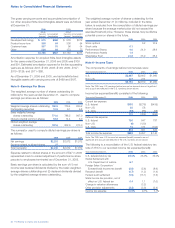

Note 13 – Accounts Payable and Other Liabilities

Accounts payable and other liabilities at December 31

consisted of the following:

2006 2005

Accounts payable $««5,643 $««5,124

Accrued compensation and

employee benefit costs 4,852 4,165

Legal, environmental, and other

contingencies(a) 1,254 1,647

Forward loss recognition(b) 532 1,114

Other 3,920 4,463

$16,201 $16,513

(a)Represents items deemed probable and estimable as discussed in Note 22.

(b)Forward loss recognition relates primarily to Airborne Early Warning & Control

in 2006 and launch and satellite contracts in 2005.

Payments associated with these liabilities may occur in periods

significantly beyond the next twelve months. Accounts payable

included $335 and $204 at December 31, 2006 and 2005,

attributable to checks written but not yet cleared by the bank.

Note 14 – Debt

We have $3,000 currently available under credit line agreements.

Boeing Capital Corporation (BCC) is named a subsidiary

borrower for up to $1,500 under these arrangements. Total

debt interest incurred, including amounts capitalized, was $657,

$713, and $790 for the years ended December 31, 2006, 2005

and 2004, respectively. Interest expense recorded by BCC is

reflected as a separate line item on our Consolidated

Statements of Operations, and is included in earnings from

operations. Total company interest payments were $657, $671,

and $722 for the years ended December 31, 2006, 2005 and

2004, respectively. We continue to be in full compliance with all

covenants contained in our debt or credit facility agreements,

including those at BCC.

On June 6, 2002, BCC established a Euro medium-term note

program in the amount of $1,500. At December 31, 2006 and

2005, BCC had zero debt outstanding under the program

such that $1,500 would normally be available for potential

debt issuance. However, debt issuance under this program

requires that documentation, information and other procedures

relating to BCC and the program be updated within the prior

twelve months. In view of BCC’s cash position and other

available funding sources, BCC determined during 2004 that

it was unlikely they would need to use this program in the fore-

seeable future. The program is thus inactive but available with

updated registration statements.

On March 23, 2004, we filed a shelf registration with the SEC

for $1,000 for the issuance of debt securities and underlying

common stock. The entire amount remains available for poten-

tial debt issuance. BCC has $3,421 that remains available from

shelf registrations filed with the SEC. Both shelf registrations will

expire in 2008.

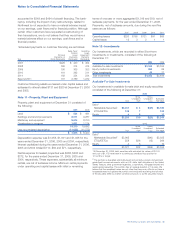

Short-term debt and current portion of long-term debt,

consisted of the following:

At December 31, 2006 At December 31, 2005

Consolidated BCC Consolidated BCC

Total Only Total Only

Senior Unsecured

Debt Securities $1,115 $1,115 $1,015 $570

Capital lease obligations 55 47 54 45

Non-recourse debt

and notes 42 4 39 4

Retail notes 141 141 77 77

Other notes 28 4

$1,381 $1,307 $1,189 $696

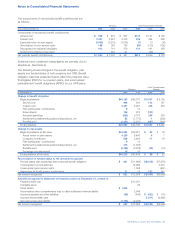

Debt consisted of the following:

December 31, December 31,

2006 2005

Boeing Capital Corporation debt:

Unsecured debt securities

3.250%–7.640% due through 2023 $5,382 $««6,048

Non-recourse debt and notes

4.840%–7.810% notes due through 2013 76 80

Capital lease obligations

4.120%–8.250% due through 2015 132 194

Subtotal Boeing Capital Corporation debt $5,590 $««6,322

Other Boeing debt:

Non-recourse debt and notes

Enhanced equipment trust $«««442 $«««««477

Unsecured debentures and notes

250, 6.875% due Nov. 1, 2006 250

175, 8.100% due Nov. 15, 2006 175

350, 9.750% due Apr. 1, 2012 349 349

600, 5.125% due Feb. 15, 2013 598 598

400, 8.750% due Aug. 15, 2021 398 398

300, 7.950% due Aug. 15, 2024

(puttable at holder’s option on

Aug. 15, 2012) 300 300

250, 7.250% due Jun. 15, 2025 247 247

250, 8.750% due Sep. 15, 2031 248 248

175, 8.625% due Nov. 15, 2031 173 173

400, 6.125% due Feb. 15, 2033 393 393

300, 6.625% due Feb. 15, 2038 300 300

100, 7.500% due Aug. 15, 2042 100 100

175, 7.875% due Apr. 15, 2043 173 173

125, 6.875% due Oct. 15, 2043 125 125

Senior medium-term notes

7.460% due through 2006 20

Capital lease obligations due through 2009 11 17

Other notes 91 62

Subtotal other Boeing debt $3,948 $««4,405

Total debt $9,538 $10,727