Boeing 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

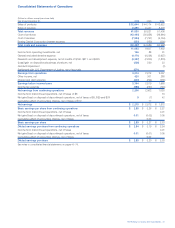

The Boeing Company and Subsidiaries 47

Notes to Consolidated Financial Statements

We continued to apply our previous accounting policy to

arrangements entered into prior to December 31, 2002 that

were not modified; such arrangements were grandfathered

under EITF 02-16 and, accordingly, we continued to recognize

concessions associated with these arrangements as revenue.

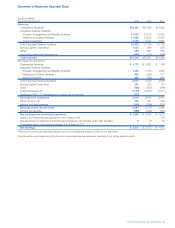

Effective January 1, 2006, we changed how we account for

concessions received from vendors that were grandfathered

under EITF 02-16. For the years ended December 31, 2005

and 2004, this change decreased Consolidated and

Commercial Airplanes segment Sales of products and

Cost of products by $1,224 and $1,057 as follows:

As

Originally Effect of As

Year ended December 31, 2005 Reported Change Adjusted

Sales of products $«45,398 $(1,224)$«44,174

Sales of services 9,447 9,447

Total revenues $«54,845 $(1,224)$«53,621

Cost of products $(38,082)$«1,224 $(36,858)

Cost of services (7,767)(7,767)

BCC interest expense (359)(359)

Total cost and expenses $(46,208)$«1,224 $(44,984)

As

Originally Effect of As

Year ended December 31, 2004 Reported Change Adjusted

Sales of products $«43,979 $(1,057)$«42,922

Sales of services 8,478 8,478

Total revenues $«52,457 $(1,057)$«51,400

Cost of products $(37,921)$«1,057 $(36,864)

Cost of services (6,754)(6,754)

BCC interest expense (350)(350)

Total cost and expenses $(45,025)$«1,057 $(43,968)

We believe the newly adopted accounting method is preferable

because it aligns our accounting for all concession arrange-

ments with vendors with guidance provided by EITF 02-16.

In accordance with EITF 02-16, reimbursements received by

a customer from a vendor are presumed to be a reduction in

the price of the vendor’s products or services and should be

treated as a reduction of Cost of products when recognized in

the customer’s income statement.

As of January 1, 2006, we have also adopted Statement of

Financial Accounting Standards (SFAS) No.154, Accounting

Changes and Error Corrections (SFAS No. 154), which requires

that changes in accounting policies such as the one described

above be applied retrospectively to all periods presented to the

extent practicable. Consequently, we have retrospectively

adjusted 2005 and 2004 to be consistent with the 2006 pres-

entation. The change had no effect on Earnings from continuing

operations, Net earnings, Retained earnings or Shareholders’

equity. The change reduced previously reported Sales of products

and Cost of products by equal amounts both on a consolidated

basis and in our Commercial Airplanes segment.

Spare Parts Revenue We recognize sales of spare parts upon

delivery and the amount reported as cost of sales is recorded

at average cost.

Service Revenue Service revenue is recognized when the serv-

ice is performed with the exception of U.S. Government service

agreements, which are accounted for using contract accounting.

Service activities primarily include the following: Delta launches,

ongoing maintenance of International Space Station and Space

Shuttle, support agreements associated with military aircraft and

helicopter contracts and technical and flight operation services

for commercial aircraft. Lease and financing revenue arrange-

ments are also included in Sales of services on the Consolidated

Statements of Operations. Service revenue and associated cost

of sales from pay-in-advance subscription fees are deferred and

recognized as services are rendered.

Financial Services Revenue We recognize financial services

revenue associated with sales-type finance leases, operating

leases, and notes receivable.

For sales-type finance leases we record an asset at lease

inception. This asset is recorded at the aggregate future mini-

mum lease payments, estimated residual value of the leased

equipment and deferred incremental direct costs less unearned

income. Income is recognized over the life of the lease to

approximate a level rate of return on the net investment. Residual

values, which are reviewed periodically, represent the estimated

amount we expect to receive at lease termination from the dispo-

sition of leased equipment. Actual residual values realized could

differ from these estimates. Declines in estimated residual value

that are deemed other than temporary are recognized as Cost of

services in the period in which the declines occur.

For operating leases, revenue on leased aircraft and equipment

representing rental fees and financing charges are recorded on

a straight-line basis over the term of the lease. Operating lease

assets, included in Customer financing, are recorded at cost

and depreciated over either the term of the lease or the economic

useful life of the asset to an estimated residual or salvage value

based on our intent to hold or dispose of the equipment before

the end of its economic useful life, using the straight-line

method. Prepayments received on operating lease contracts

are classified as Deferred lease income on the Consolidated

Statements of Financial Position. We periodically review our

estimates of residual value and recognize forecasted decreases

in residual value by prospectively adjusting depreciation expense.

For notes receivable, notes are recorded net of any unamor-

tized discounts and deferred incremental direct costs. Interest

income and amortization of any discounts are recorded ratably

over the related term of the note.

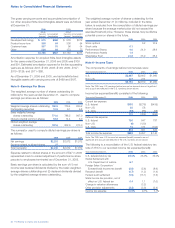

Reinsurance Revenue Our wholly-owned insurance subsidiary,

Astro Ltd., participates in a reinsurance pool for workers’

compensation. The member agreements and practices of the

reinsurance pool minimize any participating members’ individual

risk. Reinsurance revenues were $84 and $101 during 2006

and 2005, respectively. Reinsurance costs related to premiums

and claims paid to the reinsurance pool were $91 and $115

during 2006 and 2005, respectively. Both revenues and costs

are presented net in Cost of services in the Consolidated

Statements of Operations.