Boeing 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

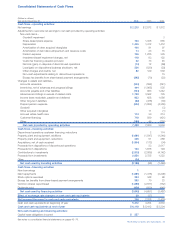

customer financing, and low income tax payments which

were partially offset by a decrease in accounts payable and

other liability.

Net cash provided by operating activities increased to $7,000 mil-

lion in 2005 from $3,504 million in 2004 primarily due to lower

pension contributions, decreased investment in customer

financing, and higher advances and billings in excess of related

costs, partially offset by increased investment in inventories.

Investing Activities Cash used for investing activities increased

to $3,186 million in 2006 from $98 million in 2005. The in-

crease is primarily due to our investment of $1,738 million in

the 2006 acquisition of Aviall, Inc. (Aviall), net of $42 million of

cash acquired, and $458 million of assumed debt, in an all-

cash merger. The assumed debt was subsequently repaid on

the acquisition closing date. In 2005, we received proceeds

of $1,676 million, primarily from the disposition of our

Commercial Airplanes operations in Wichita, Kansas and

Tulsa and McAlester, Oklahoma, and the sale of Rocketdyne.

In 2004, we received proceeds of $2,017 million from the sale

of substantially all of the assets related to BCC’s Commercial

Financial Services business.

During 2004, we invested $3,000 million of cash in an externally

managed portfolio of investment grade fixed income instru-

ments. The portfolio is diversified and highly liquid and primarily

consists of investment fixed income instruments (U.S. dollar

debt obligations of the United States Treasury, other govern-

ment agencies, corporations, mortgage-backed and asset-

backed securities). As of December 31, 2006, our externally

managed portfolio of investment grade fixed income instru-

ments had an average duration of 1.6 years. The investments

are classified as available for sale.

Financing Activities Cash used by financing activities decreased

to $3,645 million in 2006 from $4,657 million in 2005 primarily

due to lower common share repurchases. Cash used by

financing activities increased by $1,170 million in 2005 from

$3,487 million in 2004 primarily due to a $2,125 million in-

crease in common share repurchases partially offset by lower

debt repayments.

During 2006, we repurchased 21,184,202 shares at an

average price of $80.18 in our open market share repurchase

program, 3,749,377 shares at an average price of $80.28 as

part of the ShareValue Trust distribution, and 49,288 shares in

stock swaps. During 2005 and 2004, 45,217,300 shares and

14,708,856 shares were repurchased at an average price of

$63.60 and $51.09 in our open market share repurchase pro-

gram, and 33,660 shares and 50,657 shares were repurchased

in stock swaps.

In 2006, we repaid $1,681 million of debt, including $713 mil-

lion of debt held at BCC and $458 million of debt assumed in

the Aviall acquisition. In 2005 and 2004, we repaid $1,378 mil-

lion and $2,208 million of debt. Repayments in 2004 included

BCC’s redemption of $1,000 million face value of its outstand-

ing senior notes, which had a carrying value of $999 million.

BCC recognized a net loss of $42 million related to this early

debt redemption.

Credit Ratings

Our credit ratings are summarized below:

Standard &

Fitch Moody’s Poor’s

Long-term:

Boeing/BCC A+ A2 A+

Short-term:

Boeing/BCC F-1 P-1 A-1

On March 15, 2006, Moody’s Investors Service upgraded its

ratings on debt securities issued by Boeing and BCC. The

short-term rating was changed to P-1 from P-2 and the long-

term rating was changed to A2 from A3. On May 11, 2006,

Standard & Poor’s revised its outlook on Boeing and BCC to

positive from stable. On November 3, 2006, Standard & Poor’s

increased the long-term debt ratings for Boeing and BCC to

A+ from A, citing substantial cash flow and expectations that a

balanced capital allocation will continue to be pursued.

Capital Resources

We and BCC have commercial paper programs that continue

to serve as significant potential sources of short-term liquidity.

Throughout 2006 and at December 31, 2006, neither we nor

BCC had any commercial paper borrowings outstanding.

We believe we have substantial borrowing capacity. Currently,

we have $3,000 million ($1,500 million exclusively available for

BCC) of unused borrowing on revolving credit line agreements.

In 2006, we rolled over the 364-day revolving credit facility,

reducing it from $1,500 million to $1,000 million. Currently,

there is $500 million allocated to BCC. We also rolled over

the 5-year credit facility, increasing it from $1,500 million to

$2,000 million, of which $1,000 million is allocated to BCC.

We have $1,000 million that remains available from a shelf

registration filed with the SEC on March 23, 2004, and BCC

has an additional $3,421 million available for issuance, which

is due to expire in November 2008. We believe our internally

generated liquidity, together with access to external capital

resources, will be sufficient to satisfy existing commitments

and plans, and also to provide adequate financial flexibility to

take advantage of potential strategic business opportunities

should they arise within the next year.

We and Lockheed have agreed to make available to ULA a line

of credit in the amount of up to $200 million each as may be

necessary from time to time to support ULA’s Expendable

Launch Vehicle business during the five year period following

December 1, 2006. ULA did not request any funds under the

line of credit as of December 31, 2006.

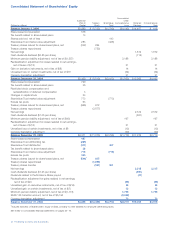

In September 2006, the FASB issued SFAS No. 158,

Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans

– an amendment of FASB Statements

No. 87, 88, 106 and 132(R)

(SFAS No. 158), which required

recognition of the funded status of defined benefit pension and

other postretirement plans, with a corresponding after-tax

adjustment to Accumulated other comprehensive loss. The

adoption of SFAS No. 158, together with the annual remeasure-

ment of our pension plans, resulted in a net $6,509 million

The Boeing Company and Subsidiaries 35

Management’s Discussion and Analysis