Boeing 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

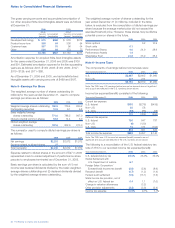

Maturities of available-for-sale debt securities at December 31,

2006, were as follows:

Amortized Estimated

Cost Fair Value

Due in 1 year or less $«««259 $«««257

Due from 1 to 5 years 1,652 1,648

Due from 5 to 10 years 186 185

Due after 10 years 1,249 1,242

$3,346 $3,332

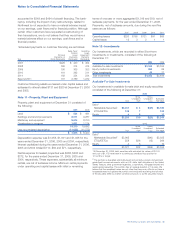

Supplemental information about gross realized gains and losses

on available-for-sale investment securities follows.

2006 2005 2004

Gains $«56

Losses, including impairments (11)$(64)$(79)

Net $«45 $(64)$(79)

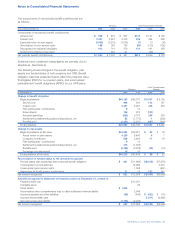

Equity Method and Other Investments

Equity Method Investments The following table reflects the

Company’s effective ownership percentages and balances of

equity method investments as of December 31, 2006 and 2005.

Ownership Investment

Segment Percentages Balance

2006 2005

United Launch Alliance N&SS 50%$960

United Space Alliance N&SS 50%(92)* $(29) *

HRL Laboratories PE&MS 50%34 28

APB Winglets Commercial 45%12 23

Airplanes

Other Primarily Commercial

Airplanes and

Support Systems 50 43

$964 $«65

*Credit balances are a result of our proportionate share of the joint venture’s

pension and postretirement related adjustments which reduce the carrying value

of the investment.

On December 1, 2006 we closed the transaction with

Lockheed Martin Corporation (Lockheed) to create a 50/50 joint

venture named United Launch Alliance L.L.C. (ULA). ULA com-

bines the production, engineering, test and launch operations

associated with U.S. Government launches of Boeing Delta and

Lockheed Atlas rockets. As a result of the transaction, we

contributed assets of $1,609, generally consisting of accounts

receivable of $372, inventories, net of advances, of $156 and

property, plant and equipment of $1,080, and liabilities of $695,

consisting of accounts payable and other liabilities of $536 and

advances and billings in excess of related costs of $159 to ULA

in exchange for 50% ownership. These amounts are subject to

adjustment pending final review of the respective parties’

contributions. We will each provide ULA with an initial cash

contribution of up to $25, and we each have agreed to extend

a line of credit to ULA of up to $200 to support its working

capital requirements. (See Notes 8, 9 and 23).

The Sea Launch venture, in which we are a 40% partner with

RSC Energia of Russia (25%), Aker ASA of Norway (20%), and

KB Yuzhnoye/PO Yuzhmash of the Ukraine (15%), provides

ocean-based launch services to commercial satellite customers.

The venture conducted five, four and three successful launches

for the years ended December 31, 2006, 2005 and 2004,

respectively. The venture incurred losses in 2006, 2005 and

2004 due to the relatively low price and volume of launches,

driven by a depressed commercial satellite market and over-

supply of launch vehicles as well as a high level of debt and

debt servicing requirements. We have financial exposure with

respect to the venture, which relates to guarantees provided

by us to certain Sea Launch creditors, performance guarantees

provided by us to a Sea Launch customer and financial

exposure related to advances and other assets reflected in

the consolidated financial statements.

We suspended recording equity losses after writing our invest-

ment in and direct loans to Sea Launch down to zero in 2001

and accruing our obligation for third-party guarantees on

Sea Launch indebtedness. We are not obligated to provide any

further financial support to the Sea Launch venture. However,

in the event that we do extend additional financial support to

Sea Launch in the future, we will recognize suspended losses

as appropriate.

A Sea Launch Zenit-3SL vehicle, carrying a Boeing-built

satellite, experienced an anomaly during launch on

January 30, 2007. The impact to Sea Launch operations,

including the remaining launches scheduled for 2007 is not

yet known. Based on our preliminary assessment, we do not

believe that this anomaly will have a material adverse impact

on our results of operations, financial position, or cash flows.

Other Investments During 2005, we recorded an asset impair-

ment charge of $42 in Other Income related to the sale of

certain investments in technology related funds for proceeds

of $24.