Boeing 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 67

Notes to Consolidated Financial Statements

Performance Shares not converted to common stock expire

five years after the date of the award. Awards may vest based

on total shareholder return as follows:

RFor 2002 awards, up to 100% of the award may vest if our

total shareholder return (stock price appreciation plus divi-

dends) during the five-year period exceeds the average total

shareholder return of the S&P 500 over the same period.

RFor 2003 and 2004 awards, up to 125% of the award may

vest based on an award formula using the total shareholder

return performance relative to the S&P 500.

RFor 2005 award, up to 125% of the award may vest based

on an award formula using the total shareholder return per-

formance relative to the S&P 100 and the five-year Treasury

Bill rate.

In the event a participant’s employment terminates due to

retirement, layoff, disability, or death, the participant (or bene-

ficiary) continues to participate in Performance Shares awards

that have been outstanding for at least one year. In all other

cases, participants forfeit unvested awards if their employment

terminates.

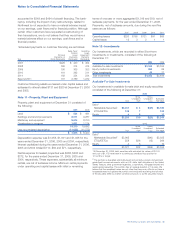

The following tables summarize information about Performance

Shares activity:

December 31, 2006

(Shares in thousands) Shares

Number of Performance Shares:

Outstanding at beginning of year 24,859

Granted

Transferred

Dividend 172

Converted or deferred (14,925)

Forfeited (593)

Canceled or expired (5,493)

Outstanding at end of year 4,020

Outstanding at end of year not contingent

on future employment 1,578

Additionally, prior to the adoption of SFAS No. 123R, we

amortized compensation cost for share-based awards over the

stated vesting period for retirement eligible employees and, if

an employee retired before the end of the vesting period, we

recognized any remaining unrecognized compensation cost at

the date of retirement. As a result of adopting SFAS No. 123R,

for all share-based awards granted after January 1, 2005, we

recognize compensation cost for retirement eligible employees

over the greater of one year from the date of grant or the

period from the date of grant to the employee’s retirement eligi-

bility date (non-substantive vesting approach). Had we also

applied the non-substantive vesting approach to awards

granted prior to 2005, compensation expense would have

been $50 and $96 lower and $59 higher for the years ended

December 31, 2006, 2005 and 2004.

Performance Shares

Performance Shares are stock units that are convertible to

com-mon stock, on a one-to-one basis, contingent upon stock

price performance. If, at any time up to five years after award,

the stock price reaches and maintains for twenty consecutive

days a price equal to stated price growth targets, a stated per-

centage (up to 125%) of the Performance Shares awarded are

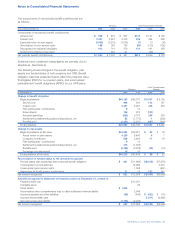

vested and convertible to common stock. The following table

shows the cumulative vesting percentages based on the cumu-

lative growth rate of the stock above the stock price at the

grant date for performance shares awarded in 2002:

Cumulative Growth 61.0%68.5%76.2%84.2%92.5%101.1%

Cumulative Vesting 25%40%55%75%100%125%

Cumulative stock price growth targets and vesting percentages

for 2003, 2004 and 2005 awards follow:

Cumulative Growth 40%50%60%70%80%90%100%110%120%125%

Cumulative Vesting 15%30%45%60%75%90%100%110%120%125%