Boeing 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company and Subsidiaries 57

Notes to Consolidated Financial Statements

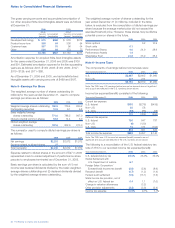

Note 9 – Exit Activity and Divestitures

During August 2006, we decided that we would exit the

Connexion by Boeing high speed broadband communications

business. Our decision resulted in a pre-tax charge of $320,

which has been recognized in Loss/(gain) on dispositions/busi-

ness shutdown, net during 2006 as outlined below:

Contract termination costs 1$«142

Write-off of assets 2492

Early contract terminations 3(314)

Total $«320

1Included termination fees associated with operating leases as well as supplier

and customer costs

2Primarily included write-off of capital lease assets

3Primarily early terminations of capital lease obligations

As of December 31, 2006, $52 was recorded in Accounts

payable and other liabilities related to contract termination

costs, which we expect to pay in 2007 to complete the business

shutdown. The exit of the Connexion by Boeing business

resulted in cash expenditures of $177 during 2006.

On February 28, 2005, we completed the stock sale of Electron

Dynamic Devices Inc. (EDD) to L-3 Communications. EDD was

a separate legal entity wholly owned by us. The corresponding

net assets of the entity were $45 and a net pre-tax gain of

$25 was recorded in the Network and Space Systems (N&SS)

segment of IDS from the sale of the net assets. In addition,

there was a related pre-tax loss of $68 recorded in Accounting

differences/eliminations for net pension and other postretire-

ment benefit curtailments and settlements. In 2006, a $15 gain

was recorded for a subsequent purchase price adjustment on

the sale.

On August 2, 2005, we completed the sale of the Rocketdyne

Propulsion and Power (Rocketdyne) business to United

Technologies Corporation for cash proceeds of approximately

$700 under an asset purchase agreement. This divestiture

includes assets and sites in California, Alabama, Mississippi,

and Florida. The Rocketdyne business primarily develops and

builds rocket engines and provides booster engines for the

space shuttle and the Delta family as well as propulsion systems

for missile defense systems. We recorded the sale in the quarter

ending September 30, 2005, and the 2005 net pre-tax gain of

approximately $578, predominantly in the N&SS segment. In

addition, we recorded a related pre-tax loss of $200 for esti-

mated pension and postretirement curtailments and settlements

in the fourth quarter of 2005 in our Other segment.

On June 16, 2005, we completed the sale of substantially all

of the assets at our Commercial Airplanes facilities in Wichita,

Kansas and Tulsa and McAlester, Oklahoma under an asset

purchase agreement to a new entity which was, subsequently,

named Spirit Aerosystems, Inc. (Spirit). Transaction considera-

tion given to us included cash of approximately $900, together

with the transfer of certain liabilities and long-term supply

agreements that provide us with ongoing cost savings. The

consolidated net loss on this sale recorded in 2005 was $287,

including pension and postretirement impacts. We recognized

a loss of $103 in 2005 in the Consolidated Statement of

Operations as Gain on dispositions, net, of which $68 was

recognized by the Commercial Airplanes segment and $35

was recognized as Accounting differences/eliminations and

Unallocated expense. The remaining loss of $184 related to

estimated pension and postretirement curtailments and

settlements, was recorded in our Other segment in the third

quarter of 2005. In 2006, a $15 gain was recorded for a

subsequent purchase price adjustment on the sale.

See Note 19 for discussion of the environmental indemnification

provisions of these agreements.

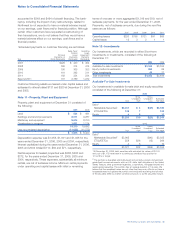

The following table summarizes the asset and liability balances

related to the Rocketdyne and Wichita/Tulsa divestitures for

2005:

Wichita/

Rocketdyne Tulsa

Assets

Accounts receivable $««62

Inventory 72 $«««467

Property, plant and equipment 96 523

Other assets 338

Prepaid pension expense 228 250

$461 $1,278

Liabilities

Accounts payable $««14 $«««««48

Employment and other 13 46

Environmental 12

Accrued retiree health care liability 28 66

$««67 $«««160

During 2004, BCC sold substantially all of the assets related to

its Commercial Financial Services business, which is reflected

as discontinued operations. Revenues were $3 and $96 for the

years ended December 31, 2005 and 2004.

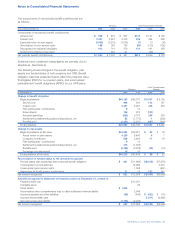

Note 10 – Customer Financing

Customer financing at December 31 consisted of the following:

2006 2005

Aircraft financing

Notes receivable $1,790 $««2,292

Investment in sales-type/finance leases 2,914 3,036

Operating lease equipment, at cost,

less accumulated depreciation of

$913 and $881 4,159 4,617

Other equipment financing

Notes receivable 33 33

Operating lease equipment, at cost,

less accumulated depreciation of

$149 and $106 248 302

Less allowance for losses on receivables (254)(274)

$8,890 $10,006