Boeing 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 The Boeing Company and Subsidiaries

Notes to Consolidated Financial Statements

At December 31, 2006, $160 of BCC debt was collateralized

by portfolio assets and underlying equipment totaling $265. The

debt consists of the 4.12% to 6.45% notes due through 2015.

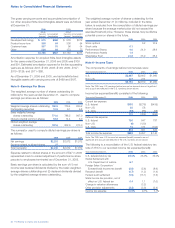

Maturities of long-term debt for the next five years are as follows:

2007 2008 2009 2010 2011

BCC $1,308 $710 $528 $646 $798

Other Boeing 74 30 23 22 74

$1,382 $740 $551 $668 $872

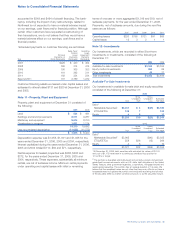

Note 15 – Postretirement Plans

We have various pension plans covering substantially all

employees. We fund all our major pension plans through trusts.

Pension assets are placed in trust solely for the benefit of the

plans’ participants, and are structured to maintain liquidity that

is sufficient to pay benefit obligations as well as to keep pace

over the long term with the growth of obligations for future

benefit payments.

We also have postretirement benefits other than pensions

which consist principally of healthcare coverage for eligible

retirees and qualifying dependents, and to a lesser extent, life

insurance to certain groups of retirees. Retiree healthcare is

provided principally until age 65 for approximately half those

retirees who are eligible for healthcare coverage. Certain

employee groups, including employees covered by most

United Auto Workers bargaining agreements, are provided

lifetime healthcare coverage. We use a measurement date of

September 30 for our pension and other postretirement

benefit (OPB) plans.

Effective December 31, 2006, we adopted SFAS No. 158,

which requires that the Consolidated Statements of Financial

Position reflect the funded status of the pension and postretire-

ment plans. The funded status of the plans is measured as

the difference between the plan assets at fair value and the

projected benefit obligation. We have recognized the aggregate

of all overfunded plans in Other assets and the aggregate of all

underfunded plans in either Accrued retiree healthcare or

Accrued pension plan liability. The portion of the amount by

which the actuarial present value of benefits included in the

projected benefit obligation exceeds the fair value of plan

assets, payable in the next 12 months, is reflected in Accounts

payable and other liabilities.

At December 31, 2006, previously unrecognized differences

between actual amounts and estimates based on actuarial

assumptions are included in Accumulated other comprehensive

loss in our Consolidated Statements of Financial Position as

required by SFAS No. 158. In future reporting periods, the

difference between actual amounts and estimates based on

actuarial assumptions will be recognized in Other comprehensive

loss in the period in which they occur.

Effective December 31, 2008, SFAS No. 158 will require us to

measure plan assets and benefit obligations at fiscal year end.

We currently perform this measurement at September 30 of

each year. In addition, beginning in fourth quarter of 2007, this

Standard will require us to eliminate the use of a three-month

lag period when recognizing the impact of curtailments or

settlements and instead, recognize these amounts in the period

in which they occur. The provisions of SFAS No. 158 do not

permit retrospective application.

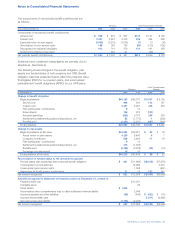

The incremental effect of adopting SFAS 158 on individual line

items in the Consolidated Statements of Financial Position at

December 31, 2006 is shown below:

Before After

Adoption Adoption

of SFAS of SFAS

No. 158 Adjustments No. 158

Deferred income taxes $««2,644 $÷÷÷193 $««2,837

Total current assets 22,790 193 22,983

Prepaid pension expense 12,808 (12,808)

Deferred income taxes 200 851 1,051

Investments 4,179 (94)4,085

Other assets 959 1,776 2,735

Total assets $61,876 $(10,082)$51,794

Accounts payable and

other liabilities $15,935 $÷÷÷266 $16,201

Total current liabilities 29,435 266 29,701

Deferred taxes 4,151 (4,151)

Accrued retiree healthcare 6,103 1,568 7,671

Accrued pension plan liability 789 346 1,135

Other long-term liabilities 260 131 391

Accumulated other

comprehensive loss 25 (8,242)(8,217)

Total liabilities &

shareholders’ equity $61,876 $(10,082)$51,794