Volvo 1999 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

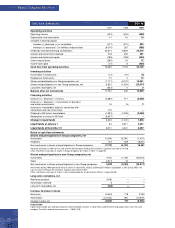

Provisions for pensions and similar benefits correspond

to the actuarially calculated value of obligations not

insured with third parties or secured through transfers of

funds to pension foundations. The amount of pensions

falling due within one year is included. AB Volvo has

insured the pension obligations with third parties. Of the

amount reported, 0 (7; 10) pertains to contractual obli-

gations within the framework of the PRI (Pension

Registration Institute) system.

In 1996, two Groupwide pension foundations for

employees were formed to secure commitments in

accordance with the ITP plan. The Volvo 1995 Pension

Foundation pertains to pension funds earned through

1995 and the Volvo 1996 Pension Foundation pertains

to funds earned beginning in 1996. In 1999, 33 (10;

12) was transferred from AB Volvo to the Volvo Pension

Foundations.

AB Volvo’s pension costs in 1999 amounted to 54

(63; 106), after withdrawal from the Volvo 1995 Pension

Foundation of 30 (-; -).

The accumulated benefit obligation of all AB Volvo’s

pension obligations at year-end 1999 amounted to 633,

which has been secured in part through Provision for

pensions and in part through funds in pension founda-

tions. Assets in the Pension Foundation, marked to mar-

ket, accruing AB Volvo exceeded pension obligations by

59.

During 1999, AB Volvo was notified that its share of

the alloted company specific surplus pension funds held

by SPP (Swedish insurance company) were approxi-

mately nominal 200. In accordance with a statement by

the Urgent Issues Committee of the Swedish Financial

Accounting Standards Council, these funds are not

reported in Volvo’s balance sheet.

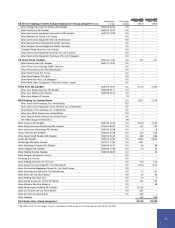

Value in Value in Value in

The composition of, and changes in, balance sheet Allocations balance sheet Allocations balance sheet

untaxed reserves: 1997 1998 1998 1999 1999

Tax allocation reserve – 978 978 297 1,275

Tax equalization reserve 265 (89) 176 (62) 114

Exchange reserve 203 (199) 4 (4) –

Accumulated extra depreciation

Machinery and equipment 13 (4) 9 (4) 5

Total 481 686 1,167 227 1,394

Untaxed reserves Note 14

Provisions for pensions Note 15

Other provisions comprise provisions for taxes in the amount of 68 (68; 63).

Long-term debt matures as follows:

2001 –

2002 3,023

2003 or later –

Total 3,023

Long-term liabilities to Group companies comprise loans

of 3,023 (9,010;10,951) from Volvo Treasury.

Other provisions Note 16

Non-current liabilities Not 17