Volvo 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal year 1999

30

Trucks

Total m arket

The world market for heavy trucks in 1999 amounted to approximately 750,000

(665,000) units. The market was characterized by strong demand and sharp competi-

tion. Markets in Western Europe and North America continued to increase from a high

level and the total number of trucks sold in both regions reached record levels,

237,000 (208,000) in Western Europe and 292,000 (236,000) in North America.

Demand in the South American markets continued to be weak during the year, while

activity in Southeast Asia increased slightly, from a low level.

Sales and m arket shares

Volvo Trucks delivered 85,090 medium-heavy and heavy trucks in 1999, 2% more than

in the preceding year. Deliveries in Western Europe totalled 39,630 (37,810) trucks

and the company’s share of the market in the heavy-truck class was 15.0% (15.2).

Trucks delivered 34,300 (29,310) units in North America.The rate of production in the

United States was increased during the year to meet the very high demand, but the

increase could not fully match the upturn in the market and Volvo’s share of the market

for heavy (Class 8) trucks in the U.S. declined slightly, from 11.5% to 10.7%. Demand

in South America declined sharply. Trucks’ deliveries in Brazil decreased during the year

to 3,230 (4,090) units, and to 7,930 (12,070) units in the rest of South America and

other parts of the world.

Trucks’ net sales amounted to SEK 69,549 M (63,837).

Order bookings declined toward the end of the year; as a result, the backlog of

orders at December 31, 1999 was 21% lower than the very high level a year earlier.

The decline was attributable to a weakening market in North America toward the end

of the year. In Western Europe the order intake continued to be on a high level and the

order book in Europe was unchanged compared to December 31, 1998.

Operating incom e

Trucks’ operating income in 1999 rose to SEK 3,905 M (1998: 3,061, excluding items

affecting comparability). The increase was attributable to larger volumes of sales in

Western Europe and North America, to a favorable trend of prices in North America,

and to lower costs of materials as a result of rationalization measures and lower prices

for purchased materials. This could compensate for severe competition in Western

Europe, investments in marketing in China and India and larger investments in

product development. The operating margin rose to 5.6% (1998: 4.8%, excluding

items affecting comparability) and the return on operating capital exceeded 25%

(1998: >25%, excluding items affecting comparability).

Production and capital expenditures

Volvo Trucks produced 84,660 (84,770) medium-heavy and heavy trucks in 1999.

Utilization of the industrial system continued to be high in both Europe and North

America. As a result of the record-high demand, Trucks’ production capacity in North

America was fully utilized during the year. An investment of slightly more than SEK

300 M was therefore made in the plant in New River Valley and the number of shifts

in the plant was increased in order to raise capacity. These measures will increase the

possible capacity by 8,000 vehicles, to 38,000 on an annual basis. However, as a conse-

quence of lower order booking at the end of 1999, the rate of production was reduced

and the plant’s capacity was not fully utilized the first part of 2000.

SEK M 1997 1998 1999

Net sales 50,840 63,837 69,549

Operating income11,812 3,061 3,905

Operating margin, %13.6 4.8 5.6

1 Excluding items affecting comparability during 1998.

Including items affecting comparability of SEK (46) M,

operating income amounted to SEK 3,015 M and

operating margin to SEK 4.7%.

1997 1998 1999

Western Europe 31,040 37,810 39,630

Eastern Europe 3,430 4,540 2,900

North America 20,900 29,310 34,300

South America 6,970 6,020 3,900

Asia 4,710 3,760 2,720

Other markets 1,930 1,840 1,640

Total 68,980 83,280 85,090

Volvo heavy Market share,

trucks registrations %

1998 1999 1998 1999

United States 24,060 28,180 11.5 10.7

Great Britain 5,600 6,090 18.3 19.3

France 5,590 5,850 14.5 13.5

Germany 3,880 4,290 7.7 7.3

Canada 3,440 4,090 12.8 13.3

Brazil 4,090 3,230 22.9 20.6

Key ratios Trucks

Num ber of vehicles invoiced Trucks

Largest m arkets Trucks

SEK M 1997 1998 1999

Western Europe 28,087 34,336 37,476

Eastern Europe 2,274 3,175 2,450

North America 12,610 18,714 23,515

South America 3,904 4,074 2,555

Asia 2,410 2,047 2,003

Other markets 1,555 1,491 1,550

Total 50,840 63,837 69,549

Net sales/ mark et

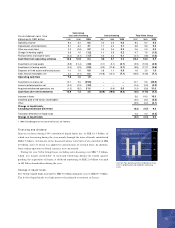

Total market developm ent Trucks

95

800

700

600

500

400

300

200

100

665 750

236 292

189 191

208

237

30

Tot al

Number of new trucks, registered, thousands >16 ton

96 97 98 99

Western

Europe

North

America

Japan

Other

32

Trucks