Volvo 1999 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

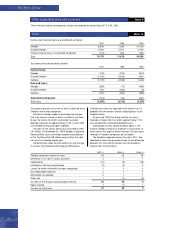

69

1997 1998 1999

Accounts receivable 13,704 16,637 14,871

Prepaid expenses and accrued income 2,867 2,918 2,601

VAT receivables 1,413 1,661 1,437

Current income tax receivables 468 656 841

Other receivables 4,290 6,071 2,797

Total, after deduction of reserves for doubtful

accounts receivable 1,147 (927; 710) 22,742 27,943 22,547

As of 1999, deferred tax assets are reported as long-term receivables.

Change of reserve for doubtful accounts receivable 1997 1998 1999

Balance sheet, December 31, preceding year 764 710 927

Change of reserve charged to income 164 126 382

Utilization of reserve related to actual losses (70) (61) (86)

Acquired and divested operations 36 37 (178)

Translation differences 48 35 (60)

Reclassifications, etc. (232) 80 162

Balance sheet, December 31, current year 710 927 1,147

Other short-term receivables Note 18

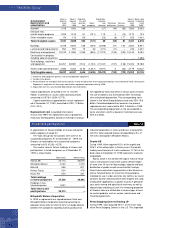

Marketable securities consist mainly of interest-bearing securities, distributed as shown below:

1997 1998 1999

Government securities 7,350 2,902 1,848

Financial institutions 272 240 5,419

Commercial paper – – 8,559

Real estate financial institutions 1,051 1,851 3,411

Securities issued by associated companies 251 1,368 725

Shares 625 783 833

Other 1,413 24 161

Total 10,962 7,168 20,956

1997 1998 1999

Cash in banks 5,435 8,771 4,324

Time deposits in banks 4,206 4,285 3,989

Total 9,641 13,056 8,313

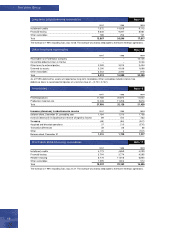

The share capital of the Parent Company is divided into

two series of shares: A and B. Both series carry the

same rights, except that each Series A share carries the

right to one vote and each Series B share carries the

right to one tenth of a vote. The number of shares is

unchanged compared with December 31, 1998.

Number of shares and par value

A (no.) B (no.) Total (no.) Par value 1

December 31, 1999 138,604,945 302,915,940 441,520,885 2,649

1 Par value per share is SEK 6.00.

Marketable securities Note 19

Cash and bank accounts Note 20

Shareholders’ equity Note 21

In accordance with the Swedish Companies Act, distribu-

tion of dividends is limited to the lesser of the unrestrict-

ed equity shown in the consolidated or Parent Company

balance sheets after proposed appropriations to restrict-

ed equity. Unrestricted equity in the Parent Company at

December 31, 1999 amounted to 65,893.

As of December 31, 1999, Volvo related foundation’s

holdings in Volvo were 1.17% of the share capital and

2.68% of the voting rights.

As shown in the consolidated balance sheet as of

December 31, 1999, unrestricted equity amounted to

82,490 (49,626; 42,829). It is estimated that 0 of this

amount will be allocated to restricted reserves.