Volvo 1999 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

62

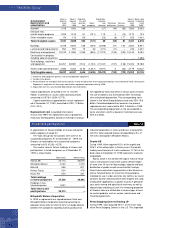

Net sales per business and market area are shown in tables on pages 24 and 26.

Other operating expenses include losses on forward and options contracts of 620 (640; 1,180) and amortization of

goodwill amounting to 398 (338; 196).

Operating income in 1999 was charged with items affect-

ing comparability amounting to 26,695 (– 2,331; –) per-

taining to the gain on sale of Volvo Cars. In 1998, items

affecting comparability pertained to the restructuring

costs aimed at adapting Volvo’s industrial structure and

the distribution and market organization. The adaption

included, for example, closure, moving or merger of

production sites. Approximately 1,300 of the total amount

1997 1998 1999

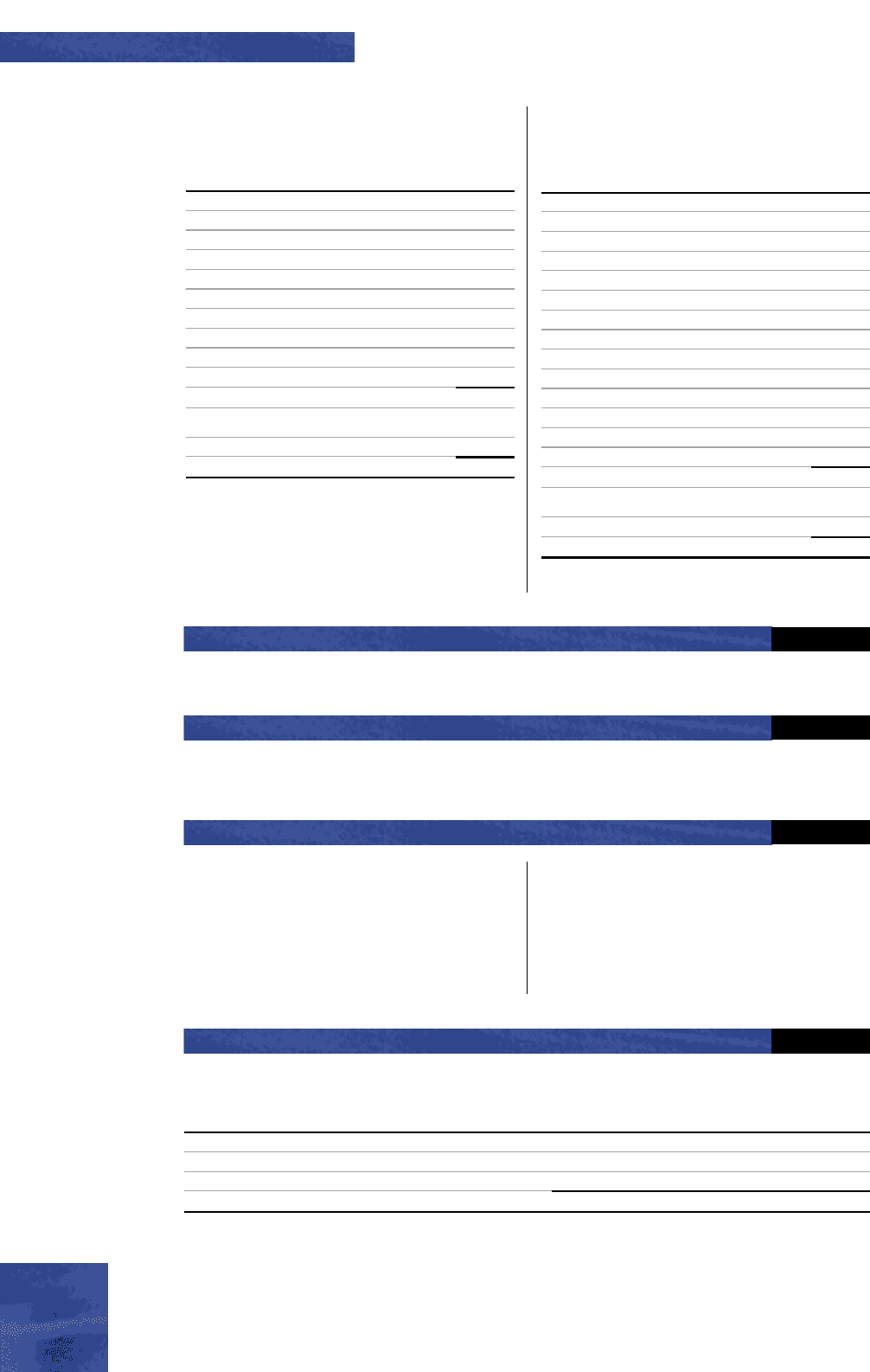

Intangible assets 253 574 525

Property, plant and equipment 4,731 5,753 2,514

Assets under operating leases 1,812 3,299 2,132

Total 6,796 9,626 5,171

Operating income excluding items affecting comparability by business area is shown in a table on page 26. Depreciation

and amortization is included in operating income and is specified by type of asset as shown below:

was attributable to contractual pensions and excess

personnel, approximately 600 to writedowns of assets,

348 in capital gain on the sale of Trucks’ rear-axle plant

in Lindesberg and the remainder, approximately 800 to

other restructuring costs. Cars accounted for 681 of the

costs, Trucks for 46, Buses 422, Construction Equipment

910, Marine and Industrial Engines 158 and other opera-

tions for 114.

Net sales Note 3

Other operating incom e and expenses Note 4

Item s affecting comparibility Note 5

Operating incom e Note 6

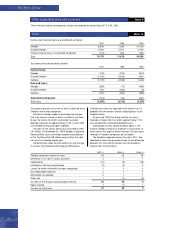

The effects during 1999 on the Volvo Group’s balance

sheet and cash flow statement in connection with the

acquisition of subsidiaries and other business

units are specified in the following table:

Intangible assets 480

Property, plant and equipment 147

Inventories 365

Current receivables 233

Liquid funds 51

Other assets 43

Minority interests 335

Provisions (72)

Loans (256)

Current liabilities (264)

Acquired net assets 1,062

Liquid funds paid (1,062)

Liquid funds according to acquisition analysis 51

Effect on Group liquid funds (1,011)

The effects during 1999 on the Volvo Group’s balance

sheet and cash flow statement in connection with the

divestment of subsidiaries and other business

units are specified in the following table:

Intangible assets (46)

Property, plant and equipment (17,915)

Assets under operating leases (12,324)

Shares and participations (100)

Inventories (11,600)

Sales-financing receivables (19,288)

Loans to external parties 110,474

Other receivables (13,203)

Liquid funds (1,602)

Minority interests 49

Provisions for postemployment benefits 866

Other provisions 11,054

Loans 28,682

Other liabilities 17,622

Divested net assets (7,331)

Liquid funds received 33,661

Liquid funds, divested companies (1,602)

Effect on Group liquid funds 32,059

1 Of which, 12,214 pertains to the not yet received portion of

consideration discounted to present value.