Volvo 1999 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

76

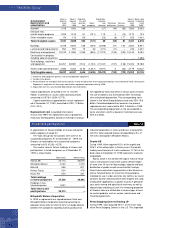

Commercial exposure

Volvo uses forward exchange contracts and currency

options to hedge the value of future payment flows.

Contracts related to hedging of anticipated sales and

purchases of foreign currency normally do not exceed

36 months. In accordance with the Group’s currency

policy, between 40% and 80% of the net flow in each

currency is hedged for the coming 12 months, 20% to

60% for months 13 through 24 and 0% to 40% for

months 25 through 36. The notional value of all forward

and options contracts as of December 31, 1999 was

SEK 25.0 billion (47.1;51.9).

Other

Inflow currencies currencies Total

SEK M USD GBP JPY EUR Net SEK

Due date 2000 amount 601 225 239 354 2.518

rate17.81 12.72 0.0674 8.93

Due date 2001 amount 461 139 180 225 961

rates17.85 12.86 0.0798 8.93

Due date 2002 amount 253 57 – 100 (193)

rate17.91 13.04 – 9.0335

Total 1,315 421 419 679 3,286

of which, options contracts 113 – – 16 –

Translated to actual value,

SEK210,301 5,388 28 5,816 3,220 24,998

Translated to SEK at

year-end exchange rates,

December 31, 1999 11,206 5,801 35 5,816 3,286 26,144

Difference between

actual value and

year-end exchange rates (905) (413) (7) 246 (66) (1,146)

Year-end exchange rates,

December 31, 1999 8.53 13.80 0.0835 8.56

1 Average contract rate.

2 Average forward contract rate and, for options, the most favorable of the year-end rate and contract rate.

Volvo Group’s net flow per currency

Other

Inflow currencies currencies Total

SEK M USD GBP JPY EUR Net SEK

Net flow 1999 amount 794 313 762 901

rate38.2742 13.3834 0.0731 8.8245

Net flow SEK, 36,570 4,189 56 7,951 3,641 22,407

Hedged portion, % 476 72 31 39

3 Average exchange rate during the financial year.

4 Outstanding currency contracts, regarding commercial exposure due in 2000, percentage of net flow 1999.

Volvo Group’s outstanding currency contracts pertaining to commercial exposure, December 31, 1999

The table shows forward exchange contracts and options contracts to hedge future flows of commercial payments.

Financial exposure

Group companies operate in local currencies. Through

loans and investments being mainly in the local currency,

financial exposure is reduced. In companies which have

loans and investments in foreign currencies, hedging is

carried out in accordance with Volvo’s financial policy,

which means limited risk-taking.

Equity exposure

In conjunction with translation of the Group’s assets and

liabilities in foreign subsidiaries to Swedish kronor, a risk

arises that the currency rate will have an effect on the

consolidated balance sheet. In accordance with the

Group’s currency policy, net investments (shareholders’

equity) in foreign subsidiaries and associated companies

are hedged up to 50%. Hedging is mainly done through

borrowing in the same currency as the net investments.

At year-end 1999, net assets in subsidiaries and associ-

ated companies outside Sweden amounted SEK 22 bil-

lion, of which 0% was hedged.