Volvo 1999 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

66

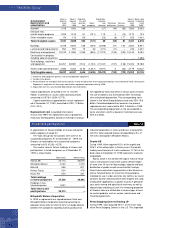

Value in Value in Deprecia- Subsidaries Value in Book value

Accumulated balance balance tion and acquired balance in balance

depreciation and sheet sheet amortiza- Sales/ and Translation Reclassi- sheet sheet

amortization 1997 1998 tion2scrapping divested differences fications 31999 1999 4

Goodwill 1,018 1,592 398 – (27) (44) (83) 1,836 5,093

Entrance fees,

aircraft engine programs 1,099 1,134 61 (131) 119 0 (13) 1,170 123

Other intangible assets 64 113 66 – (23) (8) 177 325 1,402

Total intangible assets 2,181 2,839 525 (131) 69 (52) 81 3,331 6,618

Buildings 6,478 6,840 236 (249) (3,298) (27) 152 3,654 6,921

Land and land improvements 554 597 19 (8) (371) (11) – 226 2,407

Machinery and equipment 129,019 31,550 2,259 (845) (17,372) (159) (290) 15,143 9,092

Construction in progress,

including advance payments – – – – – – – – 1,368

Total buildings, machinery

and equipment 36,051 38,987 2,514 (1,102) (21,041) (197) (138) 19,023 19,788

Assets under operating leases 2,986 5,354 2,132 (1,307) (1,971) 5 (34) 4,179 12,337

Total tangible assets 39,037 44,341 4,646 (2,409) (23,012) (192) (172) 23,202 32,125

1 Machinery and equipment pertains mainly to production equipment.

2 Includes write-downs.

3 Reclassification of intangible fixed assets pertains mainly to adjustment of the acquisition balance sheet related to Volvo Construction

Equipment’s acquisition of Samsung’s construction equipment operations during 1998.

4 Acquisition cost less accumulated depreciation and amortization.

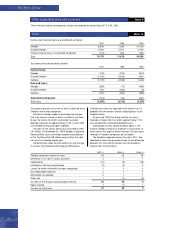

Capital expenditures amounted to 5,172 (10,549;

9,863). Investments in assets under operating leases

amounted to 5,578 (12,654; 9,773).

Capital expenditures approved but not yet implement-

ed at December 31, 1999, amounted to SEK 7.2 billion

(18.0; 20.0).

Replacement cost (unaudited information)

At year-end 1999, the replacement cost of properties,

machinery and equipment, based on methods of calcula-

tion applied by Volvo and which in certain cases involves

the use of indexes, was estimated at SEK 22.4 billion

after calculated depreciation. The corresponding value

shown in the Volvo Group balance sheet was SEK 19.8

billion. Calculated depreciation based on the present

replacement cost amounted to SEK 2.6 billion in 1999.

The corresponding depreciation in the consolidated in-

come statement, which is based on historical cost, was

SEK 2.5 billion.

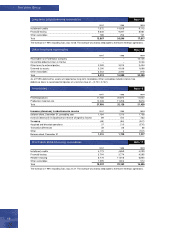

Shares and participations Note 13

Mitsubishi Motors Corporation

In 1999, an agreement was signed between Volvo and

Mitsubishi Motors Corporation covering ownership co-

operation and a letter of intent to form a strategic alliance

between the companies regarding market, product and

industrial cooperation in trucks and buses. In conjunction

with this, Volvo acquired shares corresponding to 5% of

the votes and capital in Mitsubishi Motors.

Scania AB

During 1999, Volvo acquired 43.5% of the capital and

28.6% of the voting rights in Scania, one of the world’s

leading manufacturers of trucks and buses. 17,740 of the

book value at December 31, 1999 represents unamortiz-

ed goodwill.

Scania, which is the world’s fifth largest make of heavy

trucks, manufactures trucks with a gross vehicle weight

of more than 16 tons for long haulage, regional and local

distribution of goods as well as construction haulage.

Scania’s bus and coach range consists of bus chassis as

well as fully built buses for more than 30 passengers,

intended for use in urban and inter-city traffic or as tourist

coaches. Scania’s industrial and marine engines are used,

among other applications, as power sources in generator

sets, earth-moving and agricultural machinery as well as

aboard ships and pleasure craft. An increasing proportion

of Scania’s sales are attributable to various types of servi-

ce market products, such as service, maintenance and

financing agreements.

Petro Stopping Centers Holding LP

During 1999, Volvo acquired 28.7% of the truck-stop

chain Petro Stopping Centers in the U.S. This expanded

A specification of Group holdings of shares and partici-

pations appears on page 92.

The Volvo Group has transactions with some of its

associated companies. As of December 31, 1999, the

Group’s net receivables from associated companies

amounted to 820 (6,260; 4,575).

The market value of Volvo’s holdings of shares and

participations in listed companies as of December 31,

1999 is shown below.

Book value Market value

Scania AB 23,173 26,609

Mitsubishi Motors 2,343 1,413

Bilia AB 596 871

Henlys Group 524 478

Deutz AG 670 321

Total holdings

in listed companies 27,306 29,692

Holdings in non-

listed companies 1,907 –

Total shares and

participations 29,213 —