Volvo 1999 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Minority interests in profit (loss) and in equity consist

mainly of Henlys Group’s participation in Prévost Car Inc

(49%) and the minority interests in Volvo Aero Norge AS

(22%) and in The AGES Group, ALP (14%). Through

September 1998, minority interests in profit (loss) also

included Hitachi Construction Machinery Company’s

participation in Euclid-Hitachi Heavy Equipment Inc

(40%), and up to and including June 1997, General

Motors’ holding in Volvo Trucks North America Inc

(13%).

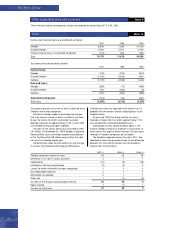

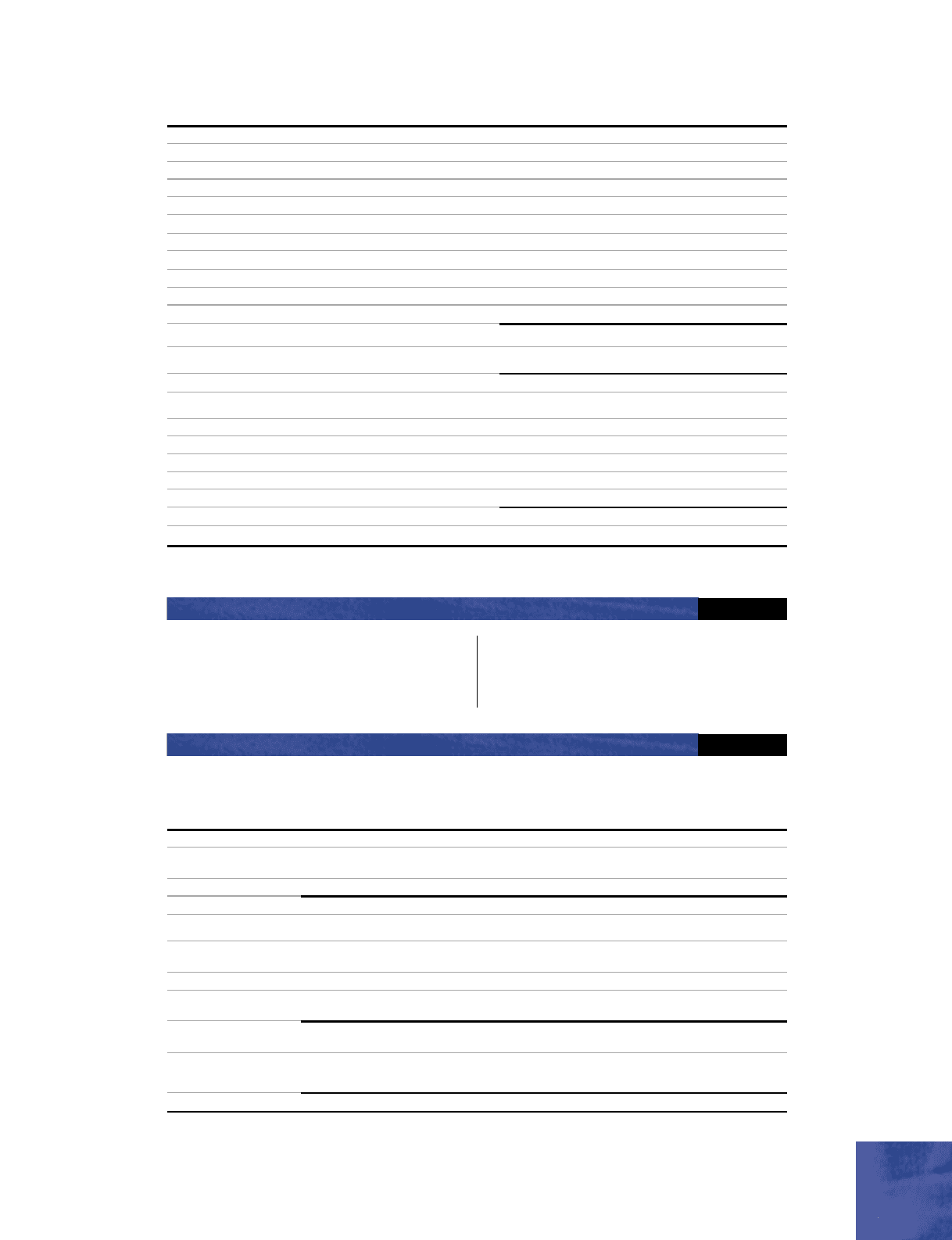

Minority interests Note 11

Specification of deferred tax assets and tax liabilities

1997 1998 1999

Deferred tax assets:

Tax loss carryforwards, gross 1,582 1,085 1,031

Other tax deductions 103 60 54

Shares and participations 236 109 55

Internal profit on inventory1– 551 223

Provision for doubtful receivables1– 227 186

Provision for guarantees1– 1,103 552

Provision for residual value risks1– 399 168

Provision for pensions1– 476 653

Provision for restructuring measures1– 562 277

Other deductible temporary differences13,838 2,157 85

5,759 6,729 3,284

Valuation allowance (1,057) (1,084) (379)

Deferred tax assets after deduction for valuation allowance 4,702 5,645 2,905

Deferred tax liabilities:

Accelerated depreciation on property, plant and equipment 1– 1,557 755

Accelerated depreciation on leasing assets 1– 897 233

LIFO valuation of inventory 1– 442 206

Untaxed reserves 1– 1,924 601

Other taxable temporary differences 5,324 956 1,662

5,324 5,776 3,457

Deferred tax liabilities, net 622 131 552

Deferred taxes are recognized after taking into account offsetting possibilities.

1 Included in other temporary differences in 1997

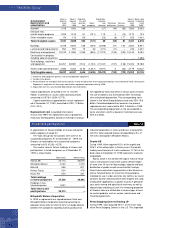

Intangible and tangible assets Note 12

Value in Value in Value in

balance balance Subsidaries balance

sheet sheet Invest- Sales/ acquired and Translation Reclassi- sheet

Acquisition costs 1997 1998 ments scrapping divested differences fications 31999

Goodwill 4,093 7,199 – – 325 158 (753) 6,929

Entrance fees, aircraft

engine programs 1,261 1,248 3 (131) 215 1 (43) 1,293

Other intangible assets 111 170 563 – (37) 35 996 1,727

Total intangible assets 5,465 8,617 566 (131) 503 194 200 9,949

Buildings 14,975 16,055 1,027 (362) (6,200) (15) 70 10,575

Land and

land improvements 2,299 3,303 182 (46) (899) 49 44 2,633

Machinery and equipment 146,497 51,642 2,662 (1,206) (28,895) (270) 302 24,235

Construction in progress

including advance payments 3,073 4,194 735 (73) (2,815) (71) (602) 1,368

Total buildings, machinery

and equipment 66,844 75,194 4,606 (1,687) (38,809) (307) (186) 38,811

Assets under

operating leases 16,487 27,639 5,578 (2,316) (14,229) 57 (213) 16,516

Total tangible assets 83,331 102,833 10,184 (4,003) (53,038) (250) (399) 55,327