Volvo 1999 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

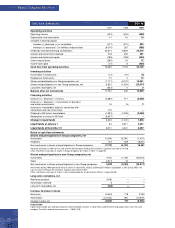

Parent Com pany AB Volvo

In 1997 and 1998, unrealized exchange gains on long-

term receivables and liabilities in foreign currencies were

allocated to an exchange reserve. Exchange differences

on borrowings and lendings, including forward contracts

related to loans, amounted to 60 ( -306; -596). Since

these loans are largely designed to hedge net assets in

foreign currencies, most of the translation differences do

not affect consolidated income. Operating related

exchange differences are included in Other operating

income and expenses. Other financial income and

expenses also include guarantee commissions from sub-

sidiaries and costs of having Volvo shares registered on

various stock exchanges as well as costs for confirmed

credit facilities.

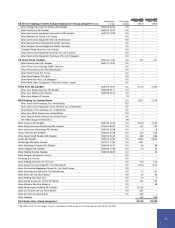

Value in Value in Value in

balance sheet balance sheet Sales/ balance

Acquisition cost 1997 1998 Investments scrapping sheet 1999

Rights — 52 — — 52

Total intangible assets – 52 — — 52

Buildings 8 17 – (10) 7

Land and land improvements 4 6 – (2) 4

Machinery and equipment 54 54 2 (3) 53

Total tangible assets 66 77 2 (15) 64

Value in Value in Value in Book value

balance sheet balance sheet Sales/ balance in balance

Accumulated depreciation 1997 21998 2Depreciation1scrapping sheet 1999 2sheet 19993

Rights — 13 13 — 26 26

Total intangible assets — 13 13 — 26 26

Buildings 1 — 1 – 1 6

Land and land improvements — — — — – 4

Machinery and equipment 35 37 5 (3) 39 14

Total tangible assets 36 37 6 (3) 40 24

The assessed value of buildings was 2 (5; 3) and of land

2 (2; 2). Investments in intangible and tangible assets

amounted to – (52; –) and 2 (20; 14) respectively.

Capital expenditures approved but not yet implemented

at year-end 1999 amounted to 1 (1; 1). An aircraft with

a book value of 28 was transferred in 1997 to the newly

formed partnership company, Blue Chip Jet HB.

1. Including write-downs

2. Including accumulated write-downs

3. Acquisition value, less depreciation

1997 1998 1999

Provision to tax allocation reserve – (978) (297)

Reversal of tax equalization reserve 89 89 62

Reversal of exchange reserve 172 199 4

Accelerated depreciation 16 4 4

Total 277 (686) (227)

Taxes, 384 (–816; –) pertain to governmental income

taxes –165 (–816; –) as well as to reversed provisions

of 549 pertaining to governmental income tax for 1998.

Provision has been made for estimated tax expenses

that may arise as a consequence of the tax audit carried

out mainly during 1992. Claims for which provisions are

not deemed necessary amount to an expense of 288

(341; 332), which is included in contingent liabilities.

Other financial incom e and expenses Note 7

Allocations Note 8

Tax es Note 9

Intangible and tangible assets Note 10