Volvo 1999 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

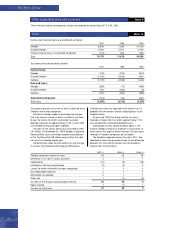

Capital expenditures

Capital expenditures include investments in buildings,

machinery and equipment, as well as in intangible assets.

Investments pertaining to assets under operating leases

are not included.

Investments in fixed assets included in the Group’s

cash flow statement include only capital expenditures that

have reduced the Group’s liquid funds during the year.

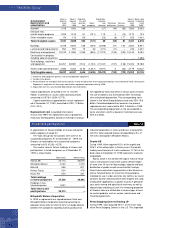

Depreciation and amortization of tangible

and intangible non-current assets

Depreciation is based on the historical cost of the

assets, adjusted in appropriate cases by write-downs,

and estimated economic lives. Capitalized type-specific

tools are generally depreciated over 2 to 8 years. The

depreciation period for assets under operating leases is

normally 3 to 5 years. Machinery is generally depreciated

over 5 to 20 years, and buildings over 25 to 50 years,

while the greater part of land improvements are depreci-

ated over 20 years. In connection with its participation in

aircraft engine projects with other companies, Volvo Aero

in certain cases pays an entrance fee. These entrance

fees are capitalized and depreciated over 5 to 10 years.

The difference between depreciation noted above and

depreciation allowable for tax purposes is reported by the

parent company and in the individual Group companies

as accumulated accelerated depreciation, which is in-

cluded in untaxed reserves. Consolidated reporting of

these items is described below under the heading

Deferred taxes, allocations and untaxed reserves.

Goodwill is included in intangible assets and amortiz-

ed on a straight-line basis over 5 to 20 years. The good-

will pertaining to Volvo Construction Equipment, Champion

Road Machinery, The AGES Group, Prévost, Nova BUS,

Mexicana de Autobuses, Volvo Construction Equipment

Korea and Volvo Aero Norge are being amortized over

20 years due to the holdings’ long-term and strategic

importance.

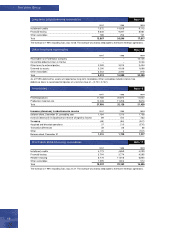

Inventories

Inventories are stated at the lower of cost, in accordance

with the first-in, first-out method (FIFO), or net realizable

value. Provisions are made for obsolescence.

Marketable securities

Marketable securities are stated at the lower of cost or

market value in accordance with the portfolio method.

Liquid funds

Liquid funds include Cash and bank balances and mar-

ketable securities. Marketable securities to some extent

consist of interest bearing securities with maturities

exceeding three months. However, these securities have

high liquidity and can easily be converted to cash.

Postemployment benefits

Most of the Volvo Group’s pension commitments are met

through continuous payments to independent authorities

or bodies that administer the plans. Pension expense

corresponding to the fees paid for these defined contri-

bution pension plans is reported continuously. In certain

of Volvo’s subsidiaries, mainly in Sweden and the U.S.,

there are defined benefit plans covering pensions and

healthcare benefits. For these plans, a provision and

annual pension expense are calculated based on the

current value of the earned future benefits. Provisions for

pensions and annual expenses related to defined pen-

sion and healthcare benefits are reported in Volvo’s con-

solidated balance sheet and income statement by apply-

ing the local rules and directives in each country.

Net sales

The Group’s reported net sales pertain mainly to revenues

from sales of goods and services. Net sales are reduced

by the value of discounts granted and by returns.

Income from the sale of goods is recognized when the

goods are delivered to the customers. Income from the

sale of workshop services is recognized when the service

is provided. Rental revenues and interest income in con-

junction with financial leasing or installment contracts is

recognized over the contract period.

Research and development expenses

and warranty expenses

Research and development expenses are charged to

income as incurred.

Estimated costs for product warranties are charged to

cost of sales when the products are sold.

Items affecting comparability

Items affecting comparability are reported separately in

the income statement. They pertain to considerable

restructuring costs and considerable gains and losses

mainly attributable to changes in the composition of the

Group.

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes

contains rules other than those identified with generally

accepted accounting principles, and which pertain to the

timing of taxation and measurement of certain commercial

transactions. Deferred taxes are provided for on differ-

ences which arise between the taxable value and reported

value of assets and liabilities (temporary differences) as

well as on tax loss carryforwards. However, with regards to

the valuation of deferred tax assets (the value of future tax

deductions), these items are recognized provided that it is

probable that the amounts can be utilized in connection

with future taxable income.

Tax laws in Sweden and certain other countries allow

companies to defer payment of taxes through allocations

to untaxed reserves. These items are treated as temporary

differences in the consolidated balance sheet, that is, a

division is made between deferred tax liability and equity

capital (restricted reserves). In the consolidated income

statement an allocation to, or withdrawal from, untaxed

reserves is divided between deferred taxes and net in-

come for the year.

Application of estimated values

In preparing the year-end financial statements in accord-

ance with generally accepted accounting principles,

company management makes certain estimates and

assumptions which affect the value of assets and liabil-

ities as well as contingent liabilities at the balance sheet

date. Reported amounts for income and expenses in the

reporting period are also affected. The actual results may

differ from these estimates.