Volvo 1999 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

74

employee gains employment during the severance period,

in an amount equal to 75% of income from new employ-

ment. An early-retirement pension may be received when

the employee reaches age 60. A pension is earned

gradually over the years up to the employee’s retirement

age and is fully earned at age 60. From that date until

reaching the normal retirement age, the retiree will receive

70% of the qualifying salary. Volvo currently has three

options programs to senior executives. The options pro-

grams have no dilutive effect on Volvo’s outstanding shares.

In February 1996, Skandia and Trygg-Hansa (insurance

companies) provided approximately 100 senior executives

in the Volvo Group an opportunity to acquire call options

on AB Volvo’s Series B shares. At the close of the sub-

scription period approximately 90% of the executives had

accepted the offer. The call options, which can be exer-

cised from March 4, 1996 until March 3, 2001, entitle the

holder to acquire 1.01 Volvo Series B share for each

option held. The exercise price is 177.70. The option price,

based on a market valuation, was fixed at the time of ac-

quisition at SEK 21.15. Members of the Group Executive

Committee were offered an opportunity to acquire 6,000

or 10,000 options each. Other senior executives could

acquire 4,000 or 6,000 options each. A total of 514,000

options were subscribed.

In October 1998, Volvo announced a new options

program, to be effective in April 1999. Approximately

100 senior executives were offered an opportunity to

participate in the options program, which includes

options on AB Volvo Series B shares. 95% of the ex-

ecutives accepted the offer.

The call options, which can be exercised from May 4,

1999 until April 2004, give a holder the right to acquire

one Series B Volvo share for each option held and the

exercise price is SEK 300. The price of the options is

based on a market valuation and was fixed at 68.70. The

number of options will equal part of the executive’s

bonus earned. A total of 91,341 shares were subscribed.

The options are financed 50% by the Company and

50% from the option holder’s bonus.

In January 2000, a decision was made to implement

a new incentive program for senior executives within the

Volvo Group in the form of so-called personnel options.

The decision covers allotment of options for 2000 and

2001, with the intention of establishing the conditions

for a rolling program with continuation also in subse-

quent years. Accordingly, during January 2000, a total of

595,000 options were allotted to about 62 senior ex-

ecutives, including President and CEO Leif Johansson

who received 50,000 options. The personnel options

allotted in January 2000 give the holder the right from

March 31, 2002 through March 31, 2003 to redeem

their options or alternatively receive shares at the value

representing the difference between the actual price at

that time and the exercise price determined at allotment.

The exercise price is SEK 244, which corresponds to

110% of the fixed allotment price. The value of the

option at allotment was set at SEK 35, which corre-

sponds to the market value.

The final allotment for 2001 will depend on the

degree of fulfillment of financial goals. The options are

financed by the company.

Profit sharing to employees for 1999, 1998 and

1997 amounted to 185, 160 and 231, respectively.

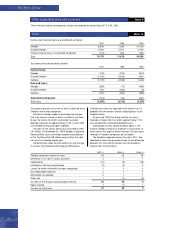

1997 1998 1999

Number of of whom, Number of of whom, Number of of whom,

Average number of employees employees women, % employees women, % employees women, %

AB Volvo

Sweden 318 56 167 57 137 60

Subsidiaries

Sweden 43,688 17 41,497 19 24,802 19

Western Europe 14,664 17 16,570 15 10,392 15

Eastern Europe 524 13 806 12 1,239 11

North America 7,870 19 12,396 17 11,860 19

South America 2,030 11 1,984 11 1,924 11

Asia 2,065 12 2,581 12 2,344 14

Other countries 679 15 627 17 450 12

Group total 71,838 18 76,628 17 53,148 17