Volvo 1999 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

64

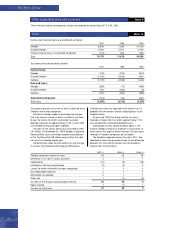

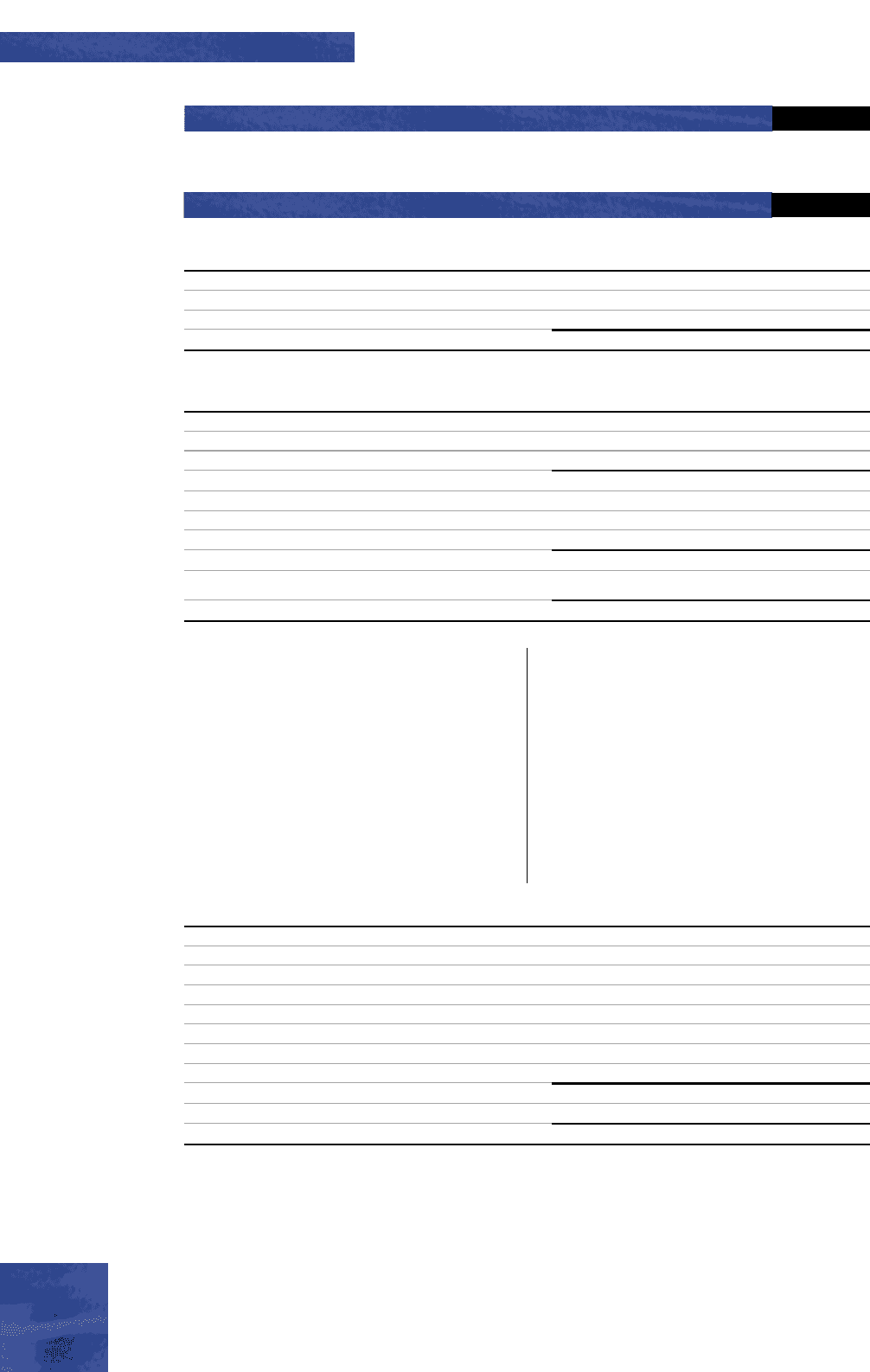

Income after financial items was distributed as follows:

1997 1998 1999

Sweden 8,828 7,089 31,268

Outside Sweden 4,464 4,070 2,763

Share of income (loss) in associated companies (116) 460 565

Total 13,176 11,619 34,596

Tax expense was distributed as follows:

1997 1998 1999

Current taxes:

Sweden (133) (975) (812)

Outside Sweden (2,145) (1,553) (651)

Subtotal (2,278) (2,528) (1,463)

Deferred taxes:

Sweden (366) (72) (480)

Outside Sweden 164 (480) (6)

Subtotal (202) (552) (486)

Associated companies (103) (60) (321)

Total taxes (2,583) (3,140) (2,270)

Tax expense pertains to current as well as deferred tax in

Swedish and foreign companies.

Provision has been made for estimated tax charges

that may arise as a result of prior tax audits in the Volvo

Group. Tax claims for which no provision has been

deemed necessary of approximately 2,754 (1,442; 699)

are included among contingent liabilities.

The gain on the sale of Volvo Cars amounted to SEK

26.7 billion. On November 25, 1999 Sweden’s Supreme

Administrative Court confirmed the preliminary decision

of the Tax Board that AB Volvo’s sale of Volvo Cars did

not result in a taxable capital gain.

Deferred taxes relate to estimated tax on the change

in tax loss carryforwards and temporary differences.

1997, % 1998, % 1999, %

Swedish corporate income tax rates 28 28 28

Difference in tax rate in various countries 2 4 1

Capital gains (13) (8) (23)

Utilization of tax-loss carryforwards (2) (2) 0

Losses for which no benefit has been recognized 2 3 1

Non-deductable expenses 2 1 0

Amortization of goodwill 0 1 1

Other, net 1 (1) (2)

Tax rate for the Group, excluding equity method 20 26 6

Equity method 1 (1) 1

Tax rate for the Group 21 25 7

Deferred tax assets are reported to the extent that it is

probable that the amount can be utilized against future

taxable income.

At year-end 1999, the Group had tax loss carry-

forwards of about 2,800, of which approximately 1,700

was recognized in calculating deferred taxes.

Accordingly, tax loss carryforwards of about 1,100

may be utilized to reduce tax expense in future years, of

which about 450 expires within five years. Tax loss carry-

forwards in Swedish companies do not expire.

The Swedish corporate income tax rate is 28%. The

table below shows the principal reason for the difference

between this rate and the Group’s tax rate, based on

income after financial items.

Tax es Note 10

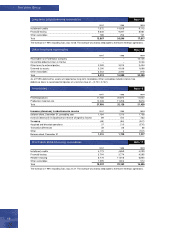

Other financial income and expenses include exchange gains amounting to 372 (164; 206).

Other financial incom e and expenses Note 9