Volvo 1999 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

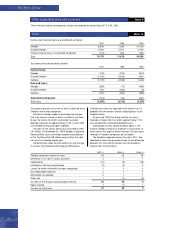

1997 1998 1999

Warranties 5,769 6,599 3,594

Provisions in insurance operations 1,890 2,139 2,491

Provisions attributable to participations in associated companies 1,851 1,819 155

Restructuring measures 556 1,718 1,621

Provison for residual value risks in sales-financing operations 1– 954 519

Provision for service contracts in sales-financing operations1– 629 913

Other provisions 5,679 7,012 3,321

Total 15,745 20,870 12,614

1 Included in other provisions in 1997.

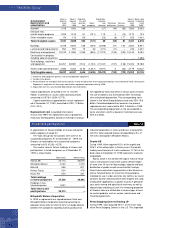

The listing below shows the Group’s non-current liabil-

ities in which the largest loans are distributed by curren-

cy. Most are issued by Volvo Treasury AB and Volvo

Group Finance Europe BV. Information on loan terms is

as of December 31, 1999. Volvo hedges foreign-

exchange and interest-rate risks using derivative instru-

ments. See also Note 32.

Bond loans 1997 1998 1999

FRF 1997-1998/ 2005–2009, 6.13–7.63% 4,618 3,887 3,271

DKK 1996-1998/ 2002-2005, 4.00-6.00% 357 704 377

SEK 1992–1999/ 2001–2008, 3.74–12.50% 1,300 3,749 3,101

JPY 1997–1999/ 2001–2005, 0.10–4.92% 3,216 2,640 4,654

ITL 1998/ 2001 — 1,357 221

NLG 1998/ 2003, 3.69% 195 214 248

DEM – 771 –

USD 1996–1999/ 2001–2008, 5.99–6.46% 1,409 1,921 1,918

EUR 1999/ 2001-2009, 2.50-5.40% — — 10,002

Other bond loans 177 381 446

Total bond loans 11,272 15,624 24,238

Other loans 1997 1998 1999

USD 1984–1999/ 2001–2017, 5.43–9.85% 3,222 3,721 2,954

GBP 1994–1999/ 2001–2009, 5.84–8.39% 2,273 777 1,151

DEM 1995–1999/ 2001–2005, 4.21% 1,491 46 489

BRL 1996–1998/ 2001–2003, 11.00–16.80% — 258 364

NLG 1998/ 2004, 6.60% 575 214 266

SEK 1992–1999/ 2003–2013, 3.63–7.50% 1,400 657 631

CAD 1981–1995/ 2002–2008, 8.66–8.89% 281 490 543

Other loans 2,421 3,567 1,586

Total other long-term loans 11,663 9,730 7,984

Other long-term liabilities 200 658 292

Total 23,135 26,012 32,514

Of the above long-term loans, 2,527 (2,823; 2,992) was secured.

Other provisions Note 23

Non-current liabilities Note 24

71

of Volvo Group pension obligations secured by these

foundations at year-end 1999 amounted to 3,355.

Assets in the pension foundations are invested in

Swedish and foreign shares and funds, as well as

interest-bearing securities. The assets, marked to mar-

ket, exceeded corresponding commitments at year-end

1999 by 575.

During 1999, Volvo was notified that its share of the

alloted company specific surplus pension funds held by

SPP (a Swedish insurance company) were approximate-

ly nominal 800. In accordance with the statement by the

Urgent Issues Committee of the Swedish Financial

Accounting Standards Council, these funds are not

reported in Volvo’s balance sheet.

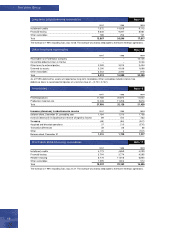

Long-term liabilities mature as follows:

2001 5,842

2002 4,092

2003 2,474

2004 9,994

2005 3,279

2006 or later 6,833

Total 32,514

At year-end 1999 credit facilities granted but not utilized

and which can be used without restrictions amounted to

approximately SEK 20 billion (22; 22). In 1999 approxi-

mately SEK 17 billion of these facilities consisted of

stand-by facilities for loans with varying maturities

through the year 2003. A fee normally not exceeding

0.25% of the unused portion is charged for credit facilities.