Volvo 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal year 1999

28

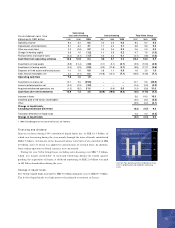

Cash flow statement

The Volvo Group’s operating cash flow in 1999, excluding sales-financing, amounted

to SEK 1.9 billion, which was SEK 0.3 billion lower than the pro forma operating cash

flow, excluding Volvo Cars (see table) in the preceding year. Operating cash flow was

charged with SEK 0.8 billion pertaining to the implementation of restructuring

measures that were approved, and for which provision was made, in 1998.

Net investments in fixed assets and leasing assets amounted to SEK 4.5 billion (5.1,

excluding Volvo Cars).

The Volvo Group’s total cash flow after net investments was negative in the amount

of SEK 4.4 billion (1998: negative, 17.8). The net of acquired and divested operations

provided SEK 31.0 billion. Acquisitions of shares reduced liquid funds by SEK 25.9

billion, and an increase in loans to external parties resulted in a negative cash flow of

SEK 3.2 billion, of which the payment for the convertible debenture loan issued by

Henlys was the largest single item. Continuing expansion within Volvo’s sales

financing of commercial products also resulted in a negative cash flow of SEK 8.2

billion. See pages 38–39 for more detailed description.

Capital expenditures

Capital expenditures for property, plant and equipment in 1999 amounted to SEK 5.2

billion (1998: 4.9, excluding Volvo Cars). Capital expenditures in Trucks, which

amounted to SEK 2.5 billion (2.6), included measures to increase possible production

capacity in the assembly plant in New River Valley in the United States, as well as in

the Swedish plants that manufacture components. In addition, investments in engine

production were made in Brazil, and marketing investments were made in Central and

Eastern Europe. Capital expenditures in Buses increased to SEK 0.6 billion (0.3), due

primarily to the ongoing restructuring of the European industrial operations that

involve concentration of production capacity in Wroclaw, Poland. Capital expendi-

tures in Construction Equipment amounted to SEK 0.6 billion (0.6), and included

completing the rebuilding of the plant in Asheville, North Carolina in the U.S. The

level of capital expenditures in Marine and Industrial Engines was unchanged, while

capital expenditures in Aero rose substantially, due primarily to the agreement

concluded with Boeing during the year.

Investments in leasing assets and sales-financing receivables (net) during 1999,

amounted to SEK 5.6 billion and SEK 7.1 billion, respectively. The investment

pertained mainly to the operations in North America and Western Europe.

Acquisitions and divestm ents

Acquisitions and divestments of subsidiaries and other business units in 1999 resulted

in a positive cash flow of SEK 31.0 billion. In connection with the sale of Volvo Cars

net liquid funds of SEK 31.8 billion was provided after deduction for the liquid funds

in the divested operations. The increased holding in The AGES Group and the acqui-

sition of 78% of Norsk Jetmotor reduced liquid funds by SEK 0.7 billion (see Note 2,

page 60 for more details). Investments in shares and participations in 1999 amounted

to SEK 25.9 billion, of which SEK 23.0 billion pertained to the acquisition of 43% of

the shares in Scania AB and SEK 2.3 billion was attributable to the acquisition of a 5%

stake in Mitsubishi Motors Corporation.

Approved but not yet implemented

at December 31, 1999

Trucks 5.3

Buses 0.5

Construction Equipment 0.5

Marine and industrial engines 0.0

Aero 0.8

Other companies and undistributed investments 0.1

Total 7.2

Operating cash flow,

excluding sales financing

Cash flow from operating activities with de-

ductions for net investments in fixed assets and

leasing assets.

Capital expenditures

Capital expenditures include investments in

buildings, machinery and equipment, as well as in

intangible assets. Investments pertaining to assets

under operating leases are not included.

Investments in fixed assets included in the

Group’s cash flow statement include only capital

expenditures that have reduced the Group’s liquid

funds during the year.

Definitions

Operating cash flow, excluding

sales-financing operations

1997 1998 1) 1999

Operating income 23.8 3.3 6.0

Depreciation 2.5 3.6 3.1

Other 3.6 0.4 (2.7)

Cash flow from

operating activities 9.9 7.3 6.4

Net investments in fixed

assets and leasing assets (3.9) (5.1) (4.5)

Operating cash flow,

Volvo Group, excluding

sales financing operations 6.0 2.2 1.9

1 Pro forma, excluding Cars. Volvo’s cash flow from

financial items in 1998 and 1997 has also been

adjusted to reflect the effects of the amount received

for Volvo Cars and the amounts paid for shares in

Scania in 1999.

2 1999: excluding gain on sale of Volvo Cars, SEK 26.7 bn.

SEK billion

December 31, 1998 14.8

Cash flow from operating activities 6.4

Net investments in fixed

assets and leasing assets (4.5)

Operating cash flow,

excluding

sales financing 1.9

Divestment of Volvo Cars 46.0

Acquisition of shares in Scania (23.0)

Acquistition of shares in Mitsubishi Motors (2.3)

Other acquired subsidiaries and shares 1(2.0)

Dividend to AB Volvo’s shareholders (2.6)

Other (1.8)

December 31, 1999 31.0

1 Including purchase amount and financial net debt in

acquired companies. See further Note 2, page 60.

Change in net financial assets SEK billion

Future capital expenditures SEK billion