Volvo 1999 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Construction Equipm ent

Total m arket

The world market for heavy construction equipment decreased slightly in 1999. The

North American market, the largest single market area in the world, declined by nearly

10%, while the market in Western Europe increased by approximately 15%. Total

demand for heavy construction equipment in other markets decreased by approxi-

mately 5%. However, signs of recovery in Asia became increasingly clear, in South

Korea among other countries and in particular during the second half of the year. The

world market for light construction equipment increased by nearly 10%.

Sales and m arket shares

Construction Equipment sold more than 20,000 units in a single year for the first time.

As a result, the company increased its share of the total market as well as its share in

a number of product groups, including excavators, articulated haulers and compact

wheel loaders.

Net sales, SEK 19,295 M (19,469), were virtually unchanged from the preceding

year. The percentage of light construction equipment sold increased, while there was

a weak decline in the heavy-equipment segment. Adjusted for divestments and acqui-

sitions, sales rose 6%. Western Europe, which accounted for 52% (49) of Construction

Equipment’s total sales, continued to be the largest single market area. North America

accounted for 31% (34) and Asia and the rest of the world for 17% of sales, unchanged

from the preceding year.

At year-end 1999, the value of the order backlog was 20% higher than on the year-

earlier date.

Operating incom e

Operating income amounted to SEK 1,736 M (1998: SEK 1,549 M, excluding items

affecting comparability), the highest ever for Construction Equipment, and the

operating margin was 9.0% (8.0). Factors contributing to the positive trend of income

included improved productivity, the restructuring of the excavator business, including

closing down operations in Eslöv, Sweden and the fact that the operation in South

Korea is making a positive contribution earlier than expected. Capital gains on the sale

of companies and lower product costs also had a favorable impact on income.

The return on operating capital in 1999 increased to 19% (1998: 18%, excluding

items affecting comparability).

Production and capital expenditures

During the year Construction Equipment completed the restructuring of its excavator

business whereby Volvo’s global center for excavators has now been established in

South Korea.

As part of the program to utilize the plant in South Korea as an industrial base for

Construction Equipment’s products in Asia, the company also began production of

articulated haulers there at the end of 1999. The rebuild of Construction Equipment’s

plant in Asheville, North Carolina, U.S., where wheel loaders and articulated haulers

are manufactured, was completed during 1999. Capital expenditures were made to

increase mechanization, to enhance flexibility and in environmental improvement

measures. Concurrently, the possible capacity was increased from 2,000 to 3,000 units

per year.

33

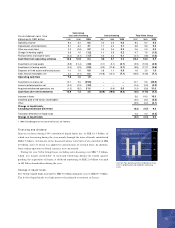

SEK M 1997 1998 1999

Western Europe 7,836 9,557 10,032

Eastern Europe 263 336 193

North America 5,785 6,645 5,982

South America 991 957 507

Asia 1,036 1,092 1,903

Other markets 847 882 678

Total 16,758 19,469 19,295

SEK M 1997 1998 1999

Net sales 16,758 19,469 19,295

Operating income 11,444 1,549 1,736

Operating margin, % 18.6 8.0 9.0

1 Excluding items affecting comparability during

1998. Including items affecting comparability of

SEK (910) M operating income amounted to SEK

639 M and operating margin was 3.3%.

Key ratios Construction Equipment

Net sales/ mark et Construction Equipment

Steve De Stefano

Salesman

The Ages Group

Florida, US

Volvo brought

focus, structure

and stability to

The Ages Group.

We have com-

bined the best of

both com panies

and stand solidly

on a com m on

platform of trust.

My view of Volvo