Volvo 1999 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

78

Credit risks in financial instruments

Credit risk in financial investments

The liquidity in the Group is invested mainly in local cash

pools or directly with Volvo Treasury. This concentrates

the credit risk within the Group’s in-house bank. Volvo

Treasury invests the liquid funds in the money and capital

markets.

All investments must meet criteria for low credit risk

and high liquidity. In accordance with Volvo’s credit policy,

counterparties for both investments and transactions in

derivatives must have received a rating of “A” or better

from one of the well-established credit-rating institutions.

Against the background of the sale of Volvo Cars the

board of AB Volvo has decided that a limited part of the

Group’s liquidity during 1999 also has been invested

with counterparties with a rating of less than A.

Counterparty risks

The derivative instruments used by Volvo to reduce its

foreign-exchange and interest-rate risk in turn give rise

to a counterparty risk, the risk that a counterparty will not

fulfill its part of a forward or options contract, and that a

potential gain will not be realized. Transactions with deri-

vative instruments are mainly conducted via Volvo

Treasury which means that the counterparty risk is con-

centrated within the Group's internal bank. Master net-

ting agreements are signed with each counterparty when

possible, to reduce the exposure. Where appropriate, the

Volvo Group arranges master netting agreements with

the counterparty to reduce exposure. The credit expos-

ure in interest-rate and foreign exchange contracts is

represented by the positive fair value – the potential gain

on these contracts – as of the reporting date. The risk

exposure is calculated daily. The credit risk in futures

contracts is limited through daily or monthly cash settle-

ments of the net change in value of open contracts. The

estimated exposure in currency interest-rate swaps, for-

ward exchange contracts and futures and options pur-

chased amounted to 3,055, 4,143 and 67 as of

December 31, 1999.

Volvo does not have any significant exposure to an

individual customer or counterparty.

Calculation of fair value of financial instruments

Volvo has used generally accepted methods to calculate

the market value of the Group’s financial instruments as

of December 31, 1997, 1998 and 1999. In the case of

instruments with maturities shorter than three months –

such as liquid funds and certain current liabilities as well

as certain short-term loans – the book value has been

assumed to closely approximate market value.

Official exchange rates and prices quoted in the open

market have been used initially for purposes of valuation.

In their absence, the valuation has been made by dis-

counting future cash flows at the market interest rate for

each maturity. These values are estimates and will not

necessarily be realized.

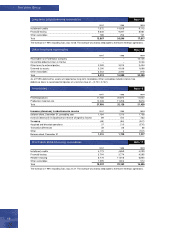

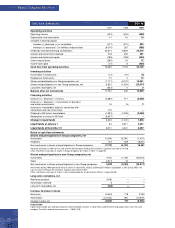

Estimated fair value of Volvo’s financial instruments

December 31, 1997 December 31, 1998 December 31, 1999

Book Fair Book Fair Book Fair

value value value value value value

Balance sheet items

Investments in shares and participations

fair value determinable12,089 5,779 1,110 851 3,537 2,212

fair value not determinable 2361 — 132 – 241 –

Long-term receivables and loans 19,690 19,682 31,349 31,362 36,240 36,751

Short-term receivables and loans 20,459 20,477 23,674 23,641 17,508 17,288

Marketable securities 10,962 11,203 7,168 7,562 20,956 21,534

Long-term loans and debts 23,135 24,168 26,012 26,882 32,514 32,394

Short-term loans 18,282 18,309 38,876 39,025 21,123 20,429

Off-balance-sheet items

Volvo Group outstanding currency contracts (199) 3(1,716) (673) 3(896) 16 (1,946)

Volvo Group outstanding interests related contracts (77) 3(957) (334) 3(266) (15) 8

Volvo Group outstanding raw material contracts – – – (77) – –

1 Pertains mainly to Volvo’s holdings in Pharmacia & Upjohn,

Inc 1997, and in Mitsubishi Motors Corporation 1999.

2 No single investment represents any significant amount.

3 Book values are included among items in the

balance sheet.