Volvo 1999 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

%

Fiscal year 1999

24

Net sales and income

Net sales

Net sales of the Volvo Group for 1999 amounted to SEK 125,019 M, compared with

SEK 114,854 M in the preceding year – excluding Volvo Cars – an increase of 9%. Net

sales were higher in Trucks, Buses, Marine and industrial engines, and Aero. Net sales

of Construction Equipment were virtually unchanged, while the business area’s

volumes of business and total market shares increased, compared with the preceding

year.

Adjusted for other companies divested and acquired, Volvo Group sales increased

8%.Trucks and Marine and industrial engines reported significant increases in sales, 9%

and 17%, respectively. Adjusted for acquired and divested companies, Construction

Equipment and Aero also reported a favorable trend of sales. Buses net sales were

unchanged, after adjustments for acquired companies.

The increase in sales continues to be attributable primarily to established markets.

Net sales in North America rose by 20%, and by 11% in Western Europe. These

markets combined account for 87% of the Group’s net sales. In Asia, demand for

Volvo’s products has gradually increased and sales have now recovered from the low

level of 1998. Construction Equipment’s acquisition in South Korea and larger

volumes delivered by both Marine and industrial engines and Aero contributed to the

increase. Demand in South America and Eastern Europe continued to weaken and

sales in these markets fell by 41% and 30%, respectively.

The number of Volvo trucks delivered in 1999 increased by 2%, to 85,090 (83,280)

and the number of buses and bus chassis delivered decreased by 7%, to 9,500 (10,200).

Construction Equipment sold more than 20,000 units for the first time.

Items affecting comparability

Items affecting comparability in 1999 included a gain of SEK 26,695 M on the sale of

Volvo Cars to Ford Motor Company. In 1998, provision amounting to SEK 2,331 M

was made for restructuring measures; of this amount, SEK 681 M pertained to Cars.

Operating incom e

Group operating income in 1999 amounted to SEK 33,249 M (6,679). Excluding

items affecting comparability, operating income amounted to SEK 6,554 M (1998:

5,202 excluding Cars), an increase of SEK 1,352 M.

The improvement in income is attributable primarily to larger volumes of sales for

the Group as a whole, to lower costs of materials and a favorable trend of prices for

Trucks in North America, to the positive effects of structural changes that were taken,

and to capital gains on the sale of companies in the Construction Equipment business

area. Income was also affected positively by a favorable foreign exchange situation as

well as by the decrease in reserves amounting to approximately SEK 240 M in Trucks’

sales-financing operations, that as a result of a favorable market trend are no longer

required. These factors compensated for the decline in volume of business in Buses

established operations and for higher product development costs for the Group as a

whole.

1999/ 1998 Consolidated as from Business area

Norsk Jetmotor AS March 1, 1999 Aero

MASA October 1, 1998 Buses

Volvo Construction Construction

Equipment Korea 2July 1, 1998 Equipment

Nova BUS April 1, 1998 Buses

BRS February 1, 1998 Trucks

Carrus Oy January 1, 1998 Buses

1 Ownership >50%

2 Previously Samsung Heavy Industries operations of

construction equipment.

For further information, see Note 2, page 60.

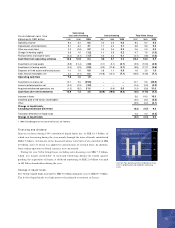

1997 1998 1999 %1

Western Europe 48,651 59,621 66,158 +11

Eastern Europe 2,769 4,160 2,899 (30)

North America 25,208 35,857 43,002 +20

South America 6,510 6,636 3,942 (41)

Asia 5,936 5,490 6,028 +10

Other markets 3,138 3,090 2,990 (3)

Volvo Group

excl Cars 92,212 114,854 125,019 +9

Cars 91,413 98,082 – –

Total 183,625 212,936 125,019 –

1 Percentage change pertains to 1999/ 1998.

Net sales per market area SEK M

Change of operating income SEK M

Operating income excluding

items affecting comparability 1998 9,010

Cars (3,808)

Increased volumes 1,120

Change in product and market mix, etc. (690)

Higher research and development expenses (260)

Decrease in provisions in

sales-financing operations 240

Capital gains on sale of companies

within Construction Equipment 210

Change in Group structure 60

Expenses incurred for a damage suit, 1998 120

Other 552

Operating income excluding

items affecting comparability 1999 6,554

Items affecting comparability 26,695

Operating income 1999 33,249

Com panies acquired 1

Excluding items

affecting comparability 1997 1998 1999

Trucks 3.6 4.8 5.6

Buses 5.2 2.7 1.6

Construction Equipment 8.6 8.0 9.0

Marine and industrial engines 4.1 1.9 5.5

Aero 6.3 6.1 5.9

Operating margin

excluding Cars 4.2 4.5 5.2

Cars 4.7 3.7 –

Total 4.6 4.2 5.2

Operating margin