Volvo 1999 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

Other items not affecting cash pertain to capital gains on

the sale of subsidiaries and other business units, –26,900

(–366; –), risk provisions and losses related to doubtful

receivables and sales-financing receivables 766 (526;

704) and other 17 (–186; –60).

Net investments in sales-financing receivables result-

ed in 1999 in a negative cash flow of SEK 7.1 billion.

In this respect, liquid funds were reduced by SEK 14.2

billion pertaining to new investments in financial leasing

contracts and installment contracts.

Net investments in shares and participations during

1999 of SEK 25.9 billion pertained in entirety to future

investments, of which the acquisition of shares in Scania

AB and Mitsubishi Motors Corporation amounted to SEK

23.0 billion and SEK 2.3 billion, respectively. During

1998, changes in the Group’s shareholdings resulted in

a positive cash flow of SEK 5.5 billion, of which the sale

of shares, mainly Pharmacia & Upjohn Inc., contributed

SEK 6.9 billion, while investments in shares reduced

liquid funds by SEK 1.4 billion. During 1997, SEK 10.9

billion was added to liquid funds through the sale of

shares, mainly in Renault SA and Pripps Ringnes AB,

while investments in shares resulted in a negative cash

flow of SEK 0.2 billion.

Net investments during the year in loans to external

parties amounted to SEK 3.2 billion, of which SEK 2.0

billion pertained to payment of the convertible debenture

loan in Henlys group and SEK 1.3 billion new investment

in corporate bonds.

The change during the year in bonds and other loans

generated liquid funds of SEK 16.3 billion. New borrow-

ing during the year, mainly the issue of bond loans, pro-

vided SEK 19 billion, while settlement of the balance

with Volvo Cars provided SEK 20 billion. Amortization

during the year amounted to SEK 23 billion, most of

which pertained to loans related to Volvo Cars and

operations in South America.

In accordance with a resolution adopted at the Annual

General Meeting, the fee paid to the Board of Directors

is a fixed amount of SEK 2,475,000, to be distributed as

decided by the Board. The Chairman of the Board, Lars

Ramqvist, receives a fee of SEK 850,000.

In 1999, Leif Johansson, President and Chief

Executive Officer, received 8,192,520 in salary and other

benefits amounting to SEK 490,847. The bonus in 1998

was SEK 1,559,639 after deduction for the option

amount. This bonus, including a 6% upward adjustment,

a total of SEK 1,653,717 was allocated to pension. Leif

Johansson received 5,045 options at a value totaling

SEK 346,586. In addition, SEK 263,305 was paid

during the year in cash, consisting of a deferred bonus

from fiscal year 1997. For 1999 the bonus is a maxi-

mum of 30% of the annual salary. Leif Johansson is

eligible to take retirement with pension at age 55.

Pension benefits are earned gradually over the years

up to the employee’s retirement age and is fully earned

at age 55. During the period between the ages of 55

and 65, he would receive a pension equal to 70% of his

pension-qualifying salary, and a pension amounting to

50% of his pension-qualifying salary after reaching the

age of 65. Leif Johansson has a twelve months notice of

termination from AB Volvo and six months on his own

initiative. If Leif Johansson’s employment is terminated

by AB Volvo, he is entitled to a severance payment equal

to two years’ salary, plus bonus.

In 1999, Sören Gyll, President and Chief Executive

Officer up to and including April 22, 1997, received SEK

325,000 in board fees and other benefits amounting to

SEK 127,059. Sören Gyll continued to serve the Group

until December 31, 1997 and then retired on pension.

The Group Executive Committee, members of the

executive committees of subsidiaries and a number of

key executives receive bonuses in addition to salaries.

Bonuses are based on the performance of the Volvo

Group and/ or of the executive’s company, in accordance

with the bonus system established by the Volvo Board in

1993 and revised in 1996, 1997 and 1998. A bonus

may, in principle, amount to a maximum of 50% of an

executive’s annual salary.

The employment contracts of certain senior execu-

tives contain provisions for severance payments when

employment is terminated by the Company, as well as

rules governing pension payments to executives who

take early retirement. The rules governing early retire-

ment provide that, when employment is terminated by

the Company, an employee is entitled to severance pay

equal to the employee’s monthly salary for a period of 12

or 24 months, depending on age at date of severance. In

certain contracts, replacing contracts concluded earlier,

an employee is entitled to severance payments amount-

ing to the employee’s monthly salary for a period of 30

to 42 months. In agreements concluded after the spring

of 1993, severance pay is reduced, in the event the

Cash flow Note 28

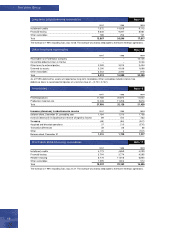

At December 31, 1999, future rental income from non-

cancellable financial and operating leases (minimum

leasing fees) amounted to 19,910 (27,272; 19,991),

of which 19,383 (26,670; 19,322) pertains to sales-

financing companies. Future rental income is distributed

as follows:

Financial leases Operating leases

2000 3,848 2,787

2001–2004 7,907 5,029

2005 or later 208 131

Total 11,963 7,947

At December 31, 1999, future rental payments related

to noncancellable leases amounted to 5,328 (7,042;

6,356). Rental expenses in 1999 amounted to 1,193

(1,826; 2,002).

Future rental payments are distributed as follows:

Financial leases Operating leases

2000 613 1,181

2001–2004 1,021 2,261

2005 or later 91 161

Total 1,725 3,603

Leasing Note 29

Personnel Note 30