Volvo 1999 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

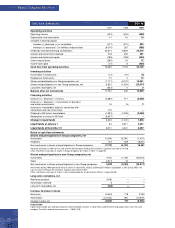

Amounts in SEK M unless otherwise specified. The

amounts within parentheses refer to the two preceding

years; the first figure is for 1998 and the second for 1997.

The accounting principles applied by Volvo are de-

scribed on pages 57-60. Reporting of Group contributions

is in accordance with the pronouncement of the Swedish

Financial Accounting Standards Council issued in

September 1998. Group contributions are reported

among Income from investments in Group companies.

In accordance with the Swedish Financial Accounting

Standards Council’s recommendations RR4 and RR5, the

figures in the comparable years are adjusted to facilitate

comparability.

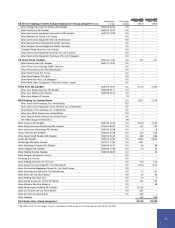

Intra-Group transactions

Of the Parent Company’s sales, 258 (623; 505) were to

NOTES TO FINANCIAL STATEM ENTS

Group companies and purchases from Group companies

amounted to 266 (235; 183).

Employees

The number of employees at year-end was 124 (169;

181). Wages, salaries and social costs amounted to 183

(179; 284). Information on the average number of

employees as well as wages, salaries and other remun-

eration is shown on pages 73-75.

Fees to auditors

Fees and other remuneration paid to external auditors

for the fiscal year 1999 totaled 15 (5), of which 5 (2)

related to auditing 5 (1) to PricewaterhouseCoopers, 0

(1) to others, and 10 (3) related to non-audit services

carried out by PricewaterhouseCoopers.

Administrative expenses include depreciation of 19 (19; 11) of which 5 (6; 11) pertained to machinery and equipment,

1 (0; 0) to buildings and 13 (13; -) to rights in the Volvo Ocean Race.

Other operating costs include profit sharing to employees in the amount of 1 (1; 1). In 1998 expenses of 118 for a lia-

bility suit pertaining to the former Group company Centro-Morgårdshammar’s products in the U.S were included.

Of the income reported, 996 (22,615; 23,563) pertained

to dividends from Group companies. Dividends for 1998

included anticipated dividends from Volvo Personvagnar

Holding AB of 17,670. Group contributions received

totaled a net of 1,416 (4,887; 4,077). Write-downs of

shareholdings amounted to 910 (908; 8,244). Income

in 1999 included gain on sales of shares of 17,784 in

Volvo Personvagnar Holding AB to Ford Motor Company.

Group-internal transfers resulted in a net loss of 558,

which primarily is attributable to capital loss on sale of

shares in Försäkringsaktiebolaget Volvia 596, and gain

Dividends from associated companies that are reported in the Group accounts in accordance with the equity method

amounted to 42 (41; 37). The participation in Blue Chip Jet HB amounted to a loss of 53 (45; 7).

Of the income reported, 194 (2; 16) pertained to dividends from other companies. Income in 1998 included a gain on

sales of shares in Stockholm Fondbörs AB of 33. Income in 1997 included a loss of 146 on the sale of Renault SA

shares.

Adm inistrative expenses Note 1

Other operating incom e and expenses Note 2

Income from investments in Group com panies Note 3

Income from investments in associated com panies Note 4

Income from other shares and participations Note 5

Interest income and similar credits amounting to 564 (341; 218) included interest in the amount of 469 (325; 210)

from subsidiaries and interest expenses and similar charges totaling 570 (760; 788), included interest totaling 543

(742; 776) paid to subsidiaries.

Interest incom e (expenses) Note 6

on the sale of Volvo Penta Italia SpA, 35. Income in

1998 included gain on sales of shares within the Group

in Danafjord AB, of 44 and a gain of 67 pertaining to

shareholder contribution to Volvo Holding Danmark A/ S

consisting of a noncash issue of shares in Volvo Person-

vogne Danmark A/ S.

Income in 1997 included a supplementary payment

of 41, for shares of Örekron International AB, which

was sold in 1988 due to Örekron having won a tax case

pertaining to 1987 taxes.