Volvo 1999 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

80

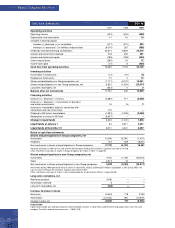

Significant differences between Swedish and U.S.

accounting principles

A. Foreign currency translation. Volvo uses forward

exchange contracts and currency options to hedge the

value of future flows of payments in foreign currency.

Outstanding contracts that are highly certain to be

covered by currency transactions are not assigned a

value in the consolidated accounts.

In accordance with U.S. GAAP, outstanding futures

contracts and currency options are valued at market

through so-called fictive closing. The profits and losses

that thereby arise are included when calculating income.

Unrealized net losses for 1999 pertaining to forwards

and options contracts are estimated at 632 (628; 1,163).

B. Income taxes. Effective in 1999, Volvo adopted the

Swedish Financial Accounting Standards Council’s

recommendation, RR9, Income Taxes, which in all mater-

ial respects corresponds with SFAS 109, Accounting for

Income Taxes, and IAS 12, Income Taxes (revised 1996).

Previously, Volvo reported deferred tax receivables re-

lated to temporary differences and tax loss carryforwards

to the extent that these could be offset against deferred

tax liabilities within the same tax jurisdiction. In 1999,

deferred tax assets are reported under the condition that

it is probable that the amount can be applied against

future taxable income. Comparative figures for 1997 and

1998 have been resteted to reflect the new accounting

principle. At the beginning of 1997, 1998 and 1999, this

resulted in an increase of the Volvo Group’s sharehold-

ers’ equity by SEK 1.4, 1.5 and 1.3 billion, respectively.

C. Business combinations. Acquisitions of certain sub-

sidiaries is reported differently in accordance with Volvo’s

accounting principles and U.S. GAAP. The difference is

attributable primarily to reporting and amortization of

goodwill.

In 1995, AB Volvo acquired the outstanding 50% of

the shares in Volvo Construction Equipment Corporation

(formerly VME) from Clark Equipment Company, in the

U.S. In conjunction with the acquisition, goodwill of SEK

2.8 billion was reported. The shareholding was written

down by SEK 1.8 billion which was estimated corres-

ponded to that portion of the goodwill that was attributable

at the time of acquisition to the Volvo trademark. In accord-

ance with U.S. GAAP, the goodwill of SEK 2.8 billion

should be amortized over its estimated useful life (20

years).

Volvo’s earnings in 1993 included a provision for an

excess value related to Volvo Trucks which resulted from

the exchange of shares with Renault. In accordance with

U.S. GAAP, the corresponding excess value should have

been reported as goodwill which was being amortized

over a period of five years.

Net income Shareholders’ equity

Goodwill 1997 1998 1999 1997 1998 1999

Goodwill in accordance with

Swedish GAAP, December 31 (196) (512)1(398) 3,075 5,607 5,093

Items affecting reporting of goodwill:

Volvo Trucks with regard to

exchange of shares with Renault (438) (439) – 439 – –

Acquisition of Volvo Construction

Equipment Corporation (91) (91) (91) 1,590 1,499 1,408

Net change in accordance with U.S. GAAP (529) (530) (91) 2,029 1,499 1,408

Approximate goodwill in accordance with

U.S. GAAP, December 31 (725) (1,042) (489) 5,104 7,106 6,501

1 Including write-downs.

1 Adjustment of shareholders’ equity in accordance with U.S. GAAP before tax effects.

2 Adjustment of income in accordance with U.S. GAAP before tax.

FAS 115- Tax and FAS 115-

Summary of debt and equity securities Market adjustment, minority adjustment,

available for sale and trading Book value value gross interests net

Trading, December 31, 1999 12,674 13,258 584 1(164) 420

Trading, January 1, 1999 3,350 3,681 331 (92) 239

Change 1999 253 2(72) 181

Available for sale

Marketable securities 7,826 7,828 2 (1) 1

Shares and convertible debenture loan 5,583 4,741 (842) 236 (606)

Available for sale

December 31, 1999 13,409 12,569 (840) 1235 (605)

January 1, 1999 3,703 3,505 (198) 55 (143)

Change 1999 (642) 180 (462)

D. Shares and participations. In calculating Volvo’s share

of earnings and shareholders’ equity in associated com-

panies in accordance with U.S. GAAP, differences

between the accounting for these companies in accord-

ance with Volvo’s principles – and U.S. GAAP have been

reflected.

Income from investments in associated companies

is reported before taxes in accordance with Swedish

accounting principles, and after tax in accordance with

U.S. GAAP. Taxes attributable to associated companies

amounted to 321 (60; 103).