Volvo 1999 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Volvo Group

60

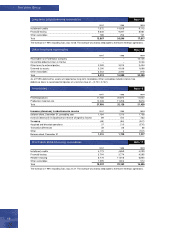

Parent Company holdings of share in subsidiaries as of

December 31, 1999 are shown on pages 94–95.

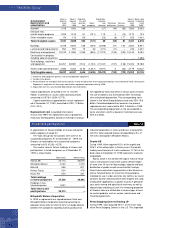

Significant acquisitions, formations and divestments

within the Group are shown below.

Volvo Maquinaria de Contruccion Espana SA

As part of the strategy to mainly organize sales through

independent dealers, Volvo Construction Equipment divest-

ed its market company in Spain in the second quarter of

1999. The buyer was Auto Sueco Lda, which previously

was Volvo’s partner in Portugal for more than 50 years.

The gain from the sale amounted to SEK 0.2 billion.

Pro-Pav and Superpac

In April 1999, Volvo Construction Equipment reached an

agreement covering the sale of its operations under the

trademarks Pro-Pav and Superpac. The operations were

previously conducted within the Canadian subsidiary

Champion Road Machinery.

Mecalac

In March 1999, Volvo Construction Equipment divested

65% of its operations involving compact machinery under

the Mecalac brand name. Concurrently, the intention to

divest the remaining 35% interest within three years was

announced.

Jet Support Corporation

As a result of the agreement between Volvo Aero and

Boeing that grants Volvo Aero exclusive rights to market

and to sell surplus spare parts to the fleet of Boeing air-

craft on the world market, primarily to aircraft types that

are no longer manufactured, the operations of American

Jet Support Corporation were acquired in April 1999.

Volvo Aero Norge AS (formerly Norsk Jetmotor AS)

During 1999, Volvo Aero acquired 78% of the shares in

Norsk Jetmotor AS in two stages for NOK 240 M. In

conjunction with the acquisition, the name of the com-

pany, which is mainly involved in production of com-

mercial aircraft components, was changed to Volvo Aero

Norge AS. Goodwill of SEK 0.1 billion that arose in con-

junction with the acquisition is being amortized over 20

years.

Volvo Malaysia Sdn Bhd

In the beginning of 1999, Federal Auto Industrial Sdn Bhd

was acquired. The company, whose name was changed

later in the year to Volvo Malaysia Sdn Bhd, conducts

importer and dealer operations in Malaysia for trucks and

buses as well as marine and industrial engines.

Volvo Cars

In January 1999, AB Volvo reached an agreement with

Ford Motor Company covering the sale of Volvo Cars.

Following approval by a General Meeting of Volvo share-

holders on March 8, and by the relevant competition

authorities, AB Volvo completed the sale of Volvo Cars to

Ford Motor Company on March 31, 1999. Under terms

of the agreement, Ford has the right to Volvo Cars’ earn-

ings beginning on January 1, 1999. In addition to a divi-

dend of SEK 17.7 billion from Volvo Personvagnar

Holding AB, AB Volvo received SEK 10.3 billion for the

shares, plus USD 2.3 billion, of which USD 1.6 billion will

be paid on March 31, 2001. In connection with the sale,

Ford assumed financial net debt of SEK 4.8 billion. The

gain from the sale amounted to SEK 26.7 billion. In con-

junction with the sale of Volvo Cars, the Volvo trademark

was transferred to a newly formed company named

Volvo Trademark Holding AB which is owned jointly by

AB Volvo and Volvo Car Corporation. The right to use the

trademark is thereby governed by a license agreement

between Volvo Trademark Holding AB and AB Volvo as

well as Volvo Car Corporation.

Mexicana de Autobuses SA de CV

In October 1998, AB Volvo acquired all of the shares

of Mexicana de Autobuses (MASA). MASA is Mexico’s

second-largest producer of tourist and intercity buses.

Goodwill amounting to SEK 0.6 billion, which is being

amortized over 20 years, arose in connection with the

acquisition.

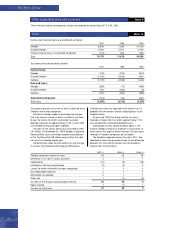

Acquisitions and divestm ents of shares in subsidiaries Note 2

Definition of key ratios

Operating margin

Operating income divided by net sales.

Return on operating capital

Operating income divided by average operating capital.

Operating capital consists of operating assets (tangible and

intangible assets, receivables and inventories) reduced by

noninterest-bearing current liabilities. This ratio is used only

for Volvo’s business areas, not for the Group as a whole.

Return on shareholders’ equity

Net income divided by average shareholders’ equity.

Interest coverage

Income divided by interest expense and similar charges.

Income includes operating income, income from invest-

ments in associated companies, income from other

investments and interest income and similar credits.

Self-financing ratio

Cash flow from operating activities (see Cash flow

analysis) divided by net investments in fixed assets and

leasing assets.

Net financial assets (net debt)

Cash and bank accounts, marketable securities and

interest-bearing short- and long-term receivables reduced

by short- and long-term interest-bearing loans. Net debt in

Volvo’s sales-financing companies is not included since

the interest expense on these liabilities is charged against

operating income and does not affect consolidated

interest net.

Share of shareholders’equity and minority interests

Shareholders’ equity and minority interests divided by

total assets.

Share of shareholders’ equity

Shareholders’ equity divided by total assets.

Income per share

Net income divided by the weighted average number of

shares outstanding during the period.