Volvo 1999 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the two preceding years; the

first figure is for 1998 and the second for 1997.

principle. At January 1, 1997, 1998 and 1999, this

resulted in an increase in The Volvo Group’s share-

holders’ equity of SEK 1.4, 1.5 and 1.3 billion, respecti-

vely.

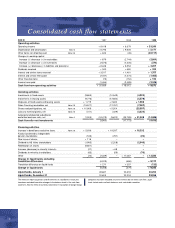

Cash flow statement

In 1999, Volvo’s cash flow statement analysis is present-

ed in accordance with the Swedish Financial Accounting

Standards Council’s recommendation, Cash Flow Account-

ing, RR7. Comparable figures for 1997 and 1998 were

restated to conform with the 1999 presentation.

Consolidated accounts

The consolidated accounts comprise the Parent Company,

all subsidiaries and associated companies. Subsidiaries

are defined as companies in which Volvo holds more

than 50% of the voting rights or in which Volvo other-

wise has a controlling influence. However, subsidiaries in

which Volvo’s holding is temporary are not consolidated.

Associated companies are companies in which Volvo has

long-term holdings equal to at least 20% but not more

than 50% of the voting rights.

The consolidated accounts are prepared in accord-

ance with the principles set forth in the Recommenda-

tion of the Swedish Financial Accounting Standards

Council, Consolidated Accounting RR1:96.

All acquisitions of companies are accounted for in

accordance with the purchase method.

Companies that have been divested are normally

included in the consolidated accounts up to and including

the date of divestment. However the measurement date

for divestment of Volvo Cars is January 1, 1999. Companies

acquired during the year are consolidated as of the date

of acquisition.

Holdings in associated companies are reported in

accordance with the equity method. The Group’s share

of reported income before taxes in such companies,

adjusted for minority interests, is included in the consoli-

dated income statement in Income from investments in

associated companies, reduced in appropriate cases by

amortization of goodwill. An amortization period of 20

years is applied for goodwill attributable to Volvo’s hold-

ing in Scania. The Group’s share of reported taxes in

associated companies, is included in Group tax expense.

For practical reasons, most of the associated com-

panies are included in the consolidated accounts with

a certain time lag, normally one quarter. Dividends from

associated companies are not included in consolidated

income. In the consolidated balance sheet, the book

value of shareholdings in associated companies is affect-

ed by Volvo’s share of the company’s income after tax,

reduced by the amortization of goodwill and by the

amount of dividends received.

Volvo’s operations

Considering the prevailing competitive situation and the

ongoing consolidation in the transport vehicle industry,

Volvo chose in the beginning of 1999 to divest Volvo

Cars to Ford Motor Company. Consequently, Volvo’s op-

erations are now concentrated in commercial vehicles

and service with the aim of further developing its market

positions in trucks, buses, construction equipment, en-

gines for marine and industrial applications and engine

components and service for the aerospace industry.

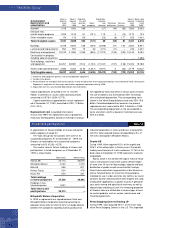

Operating structure

The Volvo Group’s operations during 1999 were organ-

ized in five product-related business areas: Trucks,

Buses, Construction Equipment, Marine and Industrial

Engines, and Aero. In addition to the five business areas,

there are certain operations consisting mainly of service

companies that are designed to support the other busi-

ness areas’ operations.

Each business area has total responsibility for its

operating income and operating capital. In 1999, business

area responsibilities included responsibility for sales-

financing activities, but certain restrictions and principles

were established centrally.

The supervision and coordination of treasury and tax

matters is organized centrally to obtain the benefits of

a Groupwide approach.

The legal structure of the Volvo Group is based on

optimal handling of treasury, tax and administrative mat-

ters and, accordingly, differs from the operating structure.

The consolidated financial statements for AB Volvo (the

Parent Company) and its subsidiaries are prepared in

accordance with Swedish GAAP. These accounting prin-

ciples differ in significant respects from U.S. GAAP, see

Note 33.

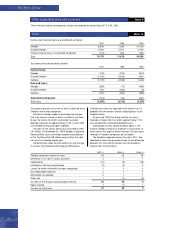

Changes in accounting principles

Income taxes

Effective in 1999, Volvo adopted the Swedish Financial

Accounting Standards Councils Recommendation,

Income Taxes, RR9, which in all significant respects

corresponds with the International Accounting Standard

Committee’s (IASC’s) recommendation, Income Taxes,

IAS 12 (revised 1996). Volvo formerly recognized de-

ferred tax assets pertaining to temporary differences, as

well as tax loss carryforwards, to the degree that these

items could be netted against deferred tax liabilities in

the same tax jurisdiction. Effective in 1999, deferred tax

assets are recognized, provided that it is probable that

the amounts can be utilized in connection with future

taxable income. The comparable figures for 1997 and

1998 have been restated to reflect the new accounting

Accounting principles Note 1

Notes to consolidated financial statements