Volvo 1999 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 1999 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

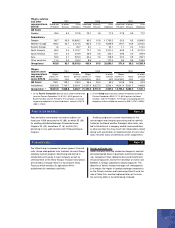

Post-retirement expenses in accordance with U.S. GAAP include:

Defined benefit plans in Sweden and U.S. 1997 1998 1999

Service cost 260 289 242

Interest cost 408 415 279

Expected return on plan assets (376) (513) (817)

Amortization, net 252 33 466

Pension costs for defined benefit plans 544 224 170

Other plans (mainly defined contribution plans) 3,051 3,030 1,332

Total pension costs in accordance with U.S. GAAP 3,595 3,254 1,502

Total pension costs in accordance with

Swedish accounting principles 3,660 3,567 1,542

Adjustment of net income for the year in accordance with

U.S. GAAP before tax effect 65 313 40

January 1, 1999 December 31, 1999

Book value Market value Book value Market value

Available for sale

Marketable securities 2,593 2,654 7,826 7,828

Shares and convertible debenture loan 1,110 851 5,583 4,741

Trading 3,350 3,681 12,674 13,258

The book values and market values for these listed securities are distributed as follows:

H. Items affecting comparability. In the Volvo Group’s

year-end accounts, costs for restructuring measures are

reported in the year that implementation of these mea-

sures was decided by each company’s Board of Directors.

In accordance with U.S. GAAP, costs are reported for

restructuring measures only under the condition that

a sufficiently detailed plan for implementation of the

measures is prepared at the end of the accounting period.

In accordance with U.S. GAAP, the gain on the sale of

Volvo Cars was lower than in accordance with Swedish

GAAP. This is mainly attributable to the accounting differ-

ences described under points A, E, H and I resulting in

a higher net asset value for the operations divested.

I. Provision for pensions and other postemployment

benefits. The greater part of the Volvo Group’s pension

commitments are defined contribution plans in which

regular payments are made to independent authorities or

bodies that administer pension plans. There is no differ-

ence between U.S. and Swedish accounting principles in

accounting for these pension plans.

Other pension commitments are defined benefit plans;

that is, the employee is entitled to receive a certain level of

pension benefits, usually related to the employee’s final

salary. In these cases the annual pension cost is calculated

based on the current value of future pension payments. In

Volvo’s consolidated accounts, provisions for pensions and

pension costs for the year in the individual companies are

calculated based on local rules and directives. In accord-

ance with U.S. GAAP, provisions for pensions and pension

costs for the year should always be calculated as specified

in SFAS 87, “Employers Accounting for Pensions”. The

difference lies primarily in the choice of discount rates and

the fact that U.S. calculations of pension benefit obliga-

tions, in contrast to Swedish calculations, are based on

salaries calculated at the time of retirement. In addition

under U.S. GAAP, the value of pension assets in excess of

the pension obligation is accounted for.

E. Interest expense. In accordance with U.S. GAAP,

interest expense incurred in connection with the financ-

ing of the construction of property and other qualifying

assets is capitalized and amortized over the economic

life of the related assets. In Volvo’s consolidated

accounts, interest expenses are reported in the year

in which the arise.

F. Leasing. Certain leasing transactions are reported

differently in accordance with Volvo’s accounting principles

compared with U.S. GAAP. The differences pertain to

sale-leaseback transactions prior to 1997.

G. Investments in debt and equity securities. In accord-

ance with U.S. GAAP, Volvo applies SFAS 115: “Account-

ing for Certain Investments in Debt and Equity Securi-

ties.” SFAS 115 addresses the accounting and reporting

for investments in equity securities that have readily

determinable fair market values, and for all debt securities.

These investments are to be classified as either “held-to-

maturity” securities that are reported at cost, “trading”

securities that are reported at fair value with unrealized

gains or losses included in earnings, or “available-for-

sale” securities, reported at fair value, with unrealized

gains or losses included in shareholders’ equity.

As of December 31, 1999, unrealized losses after

deducting for unrealized gains in “available-for-sale”

securities amounted to 840 (198; 3,747). Sale of “avail-

able-for-sale” shares in 1999 provided SEK – billion

(6.6; 6,4) and the capital gain, before tax, on sales of

these shares amounted to approximately SEK – billion

(4.5; 1,0).