Sears 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

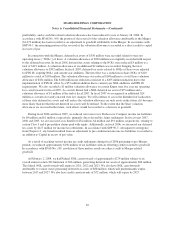

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

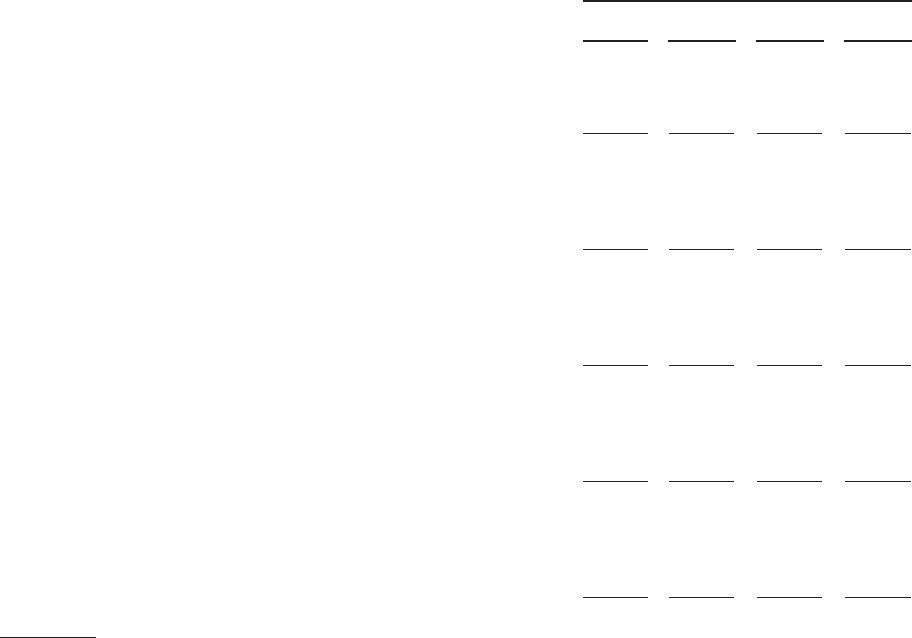

millions, except per share data

2006

First

Quarter

Second

Quarter(2)

Third

Quarter(3)

Fourth

Quarter(4)

Total revenues

Before change in Canadian year end ........................... $11,998 $12,785 $11,941 $16,288

Impact of change in Canadian year end ........................ 50 (4) 64 (106)

After change in Canadian year end ............................ $12,048 $12,781 $12,005 $16,182

Cost of sales, buying and occupancy

Before change in Canadian year end ........................... $ 8,665 $ 9,158 $ 8,557 $11,440

Impact of change in Canadian year end ........................ 32 (5) 44 (67)

After change in Canadian year end ............................ $ 8,697 $ 9,153 $ 8,601 $11,373

Selling and administrative

Before change in Canadian year end ........................... $ 2,721 $ 2,827 $ 2,834 $ 3,199

Impact of change in Canadian year end ........................ 4 (7) 16 (20)

After change in Canadian year end ............................ $ 2,725 $ 2,820 $ 2,850 $ 3,179

Net income

Before change in Canadian year end ........................... $ 180 $ 294 $ 196 $ 820

Impact of change in Canadian year end ........................ 5 4 2 (9)

After change in Canadian year end ............................ $ 185 $ 298 $ 198 $ 811

Basic and diluted net income per share

Before change in Canadian year end ........................... $ 1.14 $ 1.88 $ 1.27 $ 5.33

Impact of change in Canadian year end ........................ 0.03 0.03 0.01 (0.06)

After change in Canadian year end ............................ $ 1.17 $ 1.91 $ 1.28 $ 5.27

Earnings per share amounts for each quarter are required to be computed independently and may not equal

the amount computed for the total year.

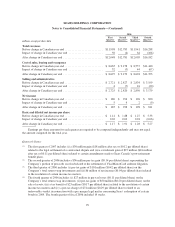

Quarterly Items:

(1) The first quarter of 2007 includes (i) a $30 million gain ($18 million after tax or $0.12 per diluted share)

related to the legal settlement of a contractual dispute and (ii) a curtailment gain of $27 million ($16 million

after tax or $0.11 per diluted share) related to certain amendments made to Sears Canada’s post-retirement

benefit plans.

(2) The second quarter of 2006 includes a $36 million pre-tax gain ($0.14 per diluted share) representing the

Company’s portion of proceeds received related to the settlement of Visa/MasterCard antitrust litigation.

(3) The third quarter of 2006 includes (i) pre-tax gains of $101 million ($0.42 per diluted share) on the

Company’s total return swap investments and (ii) $6 million of net income ($0.04 per diluted share) related

to the resolution of certain income tax matters.

(4) The fourth quarter of 2006 includes: (i) $27 million in pre-tax losses ($0.11 per diluted share) on the

Company’s total return swap investments; (ii) pre-tax gains of $50 million ($0.20 per diluted share) on the

sale of assets; (iii) a tax benefit of $25 million ($0.17 per diluted share) related to the resolution of certain

income tax matters and (iv) a pre-tax charge of $74 million ($0.29 per diluted share) related to an

unfavorable verdict in connection with a pre-merger legal matter concerning Sears’ redemption of certain

bonds in 2004. The fourth quarter of fiscal 2006 included 14 weeks.

99