Sears 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

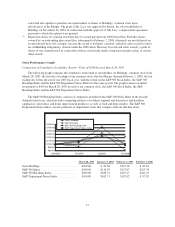

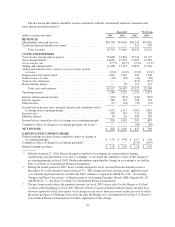

Item 6. Selected Financial Data

The table below summarizes our recent financial information. The data set forth below should be read in

conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in

Item 7 and our consolidated financial statements and notes thereto in Item 8.

Fiscal

39 Weeks

Ended

January 28,

2004

Predecessor

Company

13 Weeks

Ended

April 30,

2003dollars in millions, except per share and store data 2007 2006(4) 2005(1)(4) 2004

Summary of Operations

Total revenues(2) ..................... $50,703 $53,016 $49,455 $19,843 $17,190 $6,181

Domestic comparable sales % ........... (4.3)% (3.7)% (5.3)% (11.0)% (9.5)% (3.2)%

Income (loss) before cumulative effect of a

change in accounting principle(3) ....... 826 1,492 947 1,106 234 (852)

Cumulative effect of a change in

accounting principle, net of tax(3) ...... — — (90) — — —

Discontinued operations ............... — — — — — (10)

Net income (loss)(3) ................... 826 1,492 857 1,106 234 (862)

Per Common Share

Basic:

Continuing income (loss) .......... $ 5.71 $ 9.59 $ 6.21 $ 12.39 $ 2.61 $ (1.63)

Cumulative effect of change in

accounting principle ............ — — (0.59) — — —

Discontinued operations ........... — — — — — (0.02)

Net income (loss) ................. $ 5.71 $ 9.59 $ 5.62 $ 12.39 $ 2.61 $ (1.65)

Diluted:

Continuing income (loss) .......... $ 5.70 $ 9.58 $ 6.17 $ 11.00 $ 2.51 $ (1.63)

Cumulative effect of change in

accounting principle ............ — — (0.59) — — —

Discontinued operations ........... — — — — — (0.02)

Net income (loss) ................. $ 5.70 $ 9.58 $ 5.58 $ 11.00 $ 2.51 $ (1.65)

Book value per common share .......... $ 80.59 $ 82.60 $ 72.64 $ 50.39 $ 24.64 $19.45

Financial Data

Total assets ......................... $27,397 $29,906 $30,467 $ 8,651 $ 6,074 $6,660

Long-term debt ...................... 1,922 2,109 2,488 91 76 59

Long-term capital lease obligations ....... 684 734 786 275 374 415

Capital expenditures (Predecessor

Company for the 13 weeks ended

April 30, 2003) .................... 582 508 552 230 108 4

Number of Stores ..................... 3,847 3,791 3,843 1,480 1,511 1,513

(1) Fiscal 2005 includes the results of Sears subsequent to the Merger date. As a result, fiscal 2005 results

include approximately 44 weeks of Sears’ results and 52 weeks of Kmart’s results.

(2) We follow a retail-based financial reporting calendar. Accordingly, our fiscal 2006 results reflect the

53-week period ended February 3, 2007 whereas fiscal years 2007, 2005, and 2004 contained 52-weeks.

Fiscal 2007, 2006 and 2005 ended on the Saturday closest to January 31st. The 39 weeks ended January 28,

2004 and fiscal 2004 ended on the last Wednesday in January. The reported results for fiscal 2003 have been

divided into two parts as a result of Kmart’s emergence from Chapter 11 bankruptcy in fiscal 2003. As

further discussed in Note 13 of Notes to Consolidated Financial Statements, due to the application of

Fresh-Start Accounting (defined in Note 13 of Notes to Consolidated Financial Statements) upon emergence

from Chapter 11 bankruptcy, the reported historical financial statements of the Predecessor Company for the

periods prior to May 1, 2003 generally are not comparable to those of the Successor Company. Thus, the

results of operations of the Successor Company were not combined with those of the Predecessor Company.

19