Sears 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

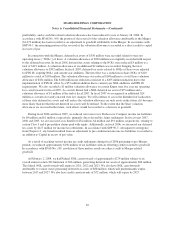

We are subject to various other legal and governmental proceedings, many involving litigation incidental to

our businesses. Some matters contain class action allegations, environmental and asbestos exposure allegations

and other consumer-based claims, each of which may seek compensatory, punitive or treble damage claims

(potentially in large amounts) or as well as other types of relief. In addition, we are a defendant in several cases

containing class-action allegations in which the plaintiffs are current and former hourly and salaried associates

who allege various wage and hour violations and unlawful termination practices. The complaints generally seek

unspecified monetary damages, injunctive relief, or both. Further, certain of these proceedings are in jurisdictions

with reputations for aggressive application of laws and procedures against corporate defendants. In accordance

with SFAS No. 5, “Accounting for Contingencies,” we accrue an undiscounted liability for those contingencies

where the incurrence of a loss is probable and the amount can be reasonably estimated and we do not record

liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be reasonably

estimated, or when the liability is believed to be only reasonably possible or remote. Because litigation outcomes

are inherently unpredictable, these assessments often involve a series of complex assessments by management

about future events and can rely heavily on estimates and assumptions. While the consequences of certain

unresolved proceedings are not presently determinable, an adverse outcome from certain matters could have a

material adverse effect on our earnings in any given reporting period. However, in the opinion of our

management after consulting with legal counsel, and taking into account insurance and reserves, the ultimate

liability is not expected to have a material adverse effect on our financial position, liquidity or capital resources.

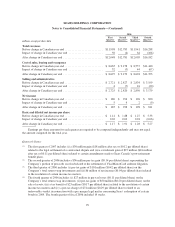

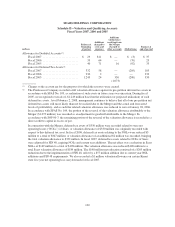

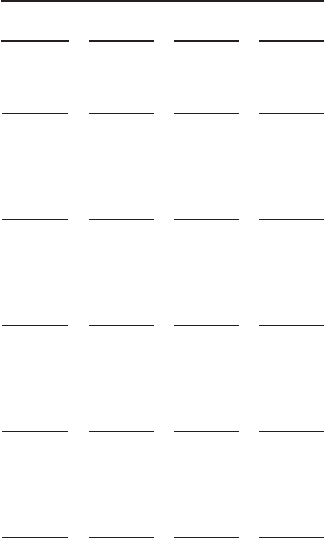

NOTE 21—QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

The following quarterly financial information reflects the impact of the change in Sears Canada’s year end.

We have retrospectively adjusted quarterly amounts previously reported as required by SFAS 154. See Note 3 for

further discussion of this change in accounting principle.

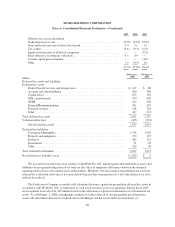

millions, except per share data

2007

First

Quarter(1)

Second

Quarter

Third

Quarter

Fourth

Quarter

Total revenues

Before change in Canadian year end ........................... $11,702 $12,239 $11,548 $15,070

Impact of change in Canadian year end ......................... 45 21 74 4

After change in Canadian year end ............................. $11,747 $12,260 $11,622 $15,074

Cost of sales, buying and occupancy

Before change in Canadian year end ........................... $ 8,417 $ 8,845 $ 8,387 $10,899

Impact of change in Canadian year end ......................... 20 24 45 1

After change in Canadian year end ............................. $ 8,437 $ 8,869 $ 8,432 $10,900

Selling and administrative

Before change in Canadian year end ........................... $ 2,634 $ 2,799 $ 2,860 $ 3,144

Impact of change in Canadian year end ......................... 10 3 24 (6)

After change in Canadian year end ............................. $ 2,644 $ 2,802 $ 2,884 $ 3,138

Net income

Before change in Canadian year end ........................... $ 216 $ 176 $ 2 $ 419

Impact of change in Canadian year end ......................... 7 (3) 2 7

After change in Canadian year end ............................. $ 223 $ 173 $ 4 $ 426

Basic and diluted net income per share

Before change in Canadian year end ........................... $ 1.40 $ 1.17 $ 0.01 $ 3.12

Impact of change in Canadian year end ......................... 0.05 (0.02) 0.02 0.05

After change in Canadian year end ............................. $ 1.45 $ 1.15 $ 0.03 $ 3.17

98