Sears 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

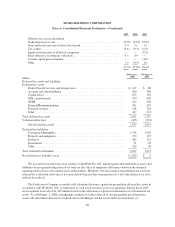

Comprehensive Income and Accumulated Other Comprehensive Loss

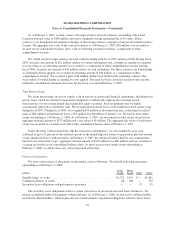

The following table shows the computation of comprehensive income:

millions

February 2,

2008

February 3,

2007

January 28,

2006

Net income ................................................... $826 $1,492 $ 857

Other comprehensive income/(loss):

Minimum pension liability adjustment, net of tax ..................... — 174 (110)

Pension and postretirement adjustments, net of tax .................... 53 — —

Deferred gain/(loss) on derivatives ................................. 1 (1) 3

Cumulative translation adjustments ................................ (44) 19 (24)

Other comprehensive income/(loss) ................................ 10 192 (131)

Total comprehensive income ..................................... $836 $1,684 $ 726

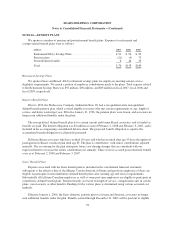

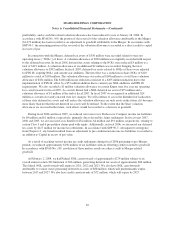

The following table displays the components of accumulated other comprehensive income (loss):

millions

February 2,

2008

February 3,

2007

January 28,

2006

Minimum pension liability, net of tax .............................. $— $— $(187)

Pension and postretirement adjustments, net of tax .................... 115 62 —

Cumulative unrealized derivative gain .............................. 3 2 3

Currency translation adjustments .................................. (49) (5) (24)

Accumulated other comprehensive income (loss) ..................... $ 69 $ 59 $(208)

NOTE 13—BANKRUPTCY CLAIMS RESOLUTION AND SETTLEMENTS

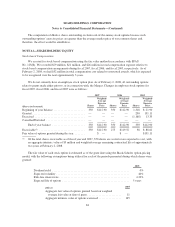

Background

On May 6, 2003, Kmart Corporation (the “Predecessor Company”), a predecessor operating company of

Kmart, emerged from reorganization proceedings under Chapter 11 of the federal bankruptcy laws pursuant to

the terms of a plan of reorganization (the “Plan of Reorganization”). The Predecessor Company is a direct,

wholly-owned subsidiary of Kmart and an indirect, wholly-owned subsidiary of Holdings. Upon emergence, all

of the then outstanding equity securities of the Predecessor Company, as well as substantially all of its

pre-petition liabilities were cancelled. On the day of emergence, 89.7 million shares of Kmart common stock and

options to purchase 8.2 million shares of Kmart common stock were issued pursuant to the Plan of

Reorganization, of which 31.9 million shares of the Kmart common stock issued were allocated to satisfy the

pre-petition claims of unsecured Class 5 creditors.

In connection with the emergence from Chapter 11, Kmart reflected the terms of the Plan of Reorganization

in its consolidated financial statements, applying the terms of SOP 90-7 with respect to financial reporting upon

emergence from Chapter 11 (“Fresh-Start Accounting”). Upon applying Fresh-Start Accounting, a new reporting

entity was deemed to have been created and the recorded amounts of assets and liabilities were adjusted to reflect

their estimated fair values.

86