Sears 2007 Annual Report Download - page 48

Download and view the complete annual report

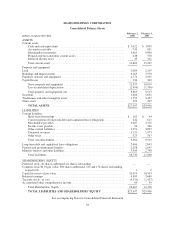

Please find page 48 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.balance sheets represents an estimate of the ultimate cost of claims incurred as of the balance sheet date. In

estimating this liability, we utilize loss development factors based on Company-specific data to project the future

development of incurred losses. Loss estimates are adjusted based upon actual claims settlements and reported

claims. These projections are subject to a high degree of variability based upon future inflation rates, litigation

trends, legal interpretations, benefit level changes and claim settlement patterns. Although we do not expect the

amounts ultimately paid to differ significantly from our estimates, self-insurance reserves could be affected if

future claim experience differs significantly from the historical trends and the actuarial assumptions.

Defined Benefit Retirement Plans

The fundamental components of accounting for defined benefit retirement plans consist of the compensation

cost of the benefits earned, the interest cost from deferring payment of those benefits into the future and the

results of investing any assets set aside to fund the obligation. Such retirement benefits were earned by associates

ratably over their service careers. Therefore, the amounts reported in the income statement for these retirement

plans have historically followed the same pattern. Accordingly, changes in the obligations or the value of assets

to fund them have been recognized systematically and gradually over the associate’s estimated period of service.

The largest drivers of experience losses in recent years have been the discount rate used to determine the present

value of the obligation and the actual return on pension assets. We recognize the changes by amortizing

experience gains/losses in excess of the 10% corridor into expense over the associate service period and by

recognizing the difference between actual and expected asset returns over a five-year period. The Sears domestic

pension plans had no unrecognized experience gain or loss as of the date of the Merger.

Effective January 31, 1996, Kmart’s pension plans were frozen, and associates no longer earn additional

benefits under the plans. Therefore, there are no assumptions related to future compensation costs relating to the

Kmart pension plans. During the first quarter of 2005, Holdings announced that the Sears domestic pension plan

would be frozen effective January 1, 2006. Accordingly, domestic associates have earned no additional benefits

subsequent to December 31, 2005. Benefits earned through December 31, 2005 will be paid out to eligible

participants following retirement.

Holdings’ actuarial valuations utilize key assumptions including discount rates and expected returns on plan

assets. We are required to consider current market conditions, including changes in interest rates and plan asset

investment returns, in determining these assumptions. Actuarial assumptions may differ materially from actual

results due to changing market and economic conditions, changes in investment strategies, higher or lower

withdrawal rates and longer or shorter life spans of participants.

Income Taxes

We account for income taxes under SFAS No. 109, “Accounting for Income Taxes,” and FASB

Interpretation No. 48, “Accounting for Uncertainty in Income Taxes–an Interpretation of FASB Statement

No. 109”. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to

differences between the book basis and tax basis of assets and liabilities. Deferred tax assets and liabilities are

measured using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. If future utilization of deferred tax assets is uncertain, the

Company may record a valuation allowance against certain deferred tax assets.

Prior to the adoption of FIN 48 on February 4, 2007, we recorded tax contingencies based on the accounting

guidance set forth in SFAS No. 5, which requires a contingency to be both probable and reasonably estimable for

a loss to be recorded. Upon adoption of FIN 48, Holdings began recording unrecognized tax benefits for

positions taken or expected to be taken on tax returns, including the decision to exclude certain income or

transactions from a return, when a more-likely-than-not threshold is met for a tax position and management

believes that the position will be sustained upon examination by the taxing authorities. In accordance with FIN

48, we record the largest amount of the unrecognized tax benefit that is greater than 50% likely of being realized

48