Sears 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

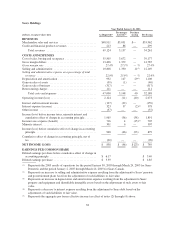

(4) On November 15, 2005, we completed the sale of substantially all assets and liabilities of Sears Canada’s

Credit and Financial Services operations. Accordingly, the credit and financial product revenues of $299

million for the pro forma fiscal year ended 2005 are not expected to re-occur.

(5) Represents the 2005 results of operations for the period from March 25, 2005 through December 31, 2005

for Sears Canada. Results of Sears Canada for the period March 25, 2005 through December 31, 2005 have

not been updated to reflect the impact of its change in year end, which occurred during the fourth quarter of

fiscal 2007.

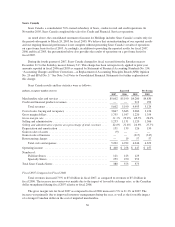

ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION

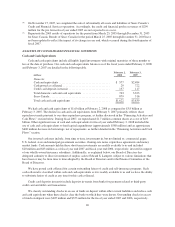

Cash and Cash Equivalents

Cash and cash equivalents include all highly liquid investments with original maturities of three months or

less at the date of purchase. Our cash and cash equivalents balances as of the fiscal years ended February 2, 2008

and February 3, 2007 are detailed in the following table.

millions

February 2,

2008

February 3,

2007

Domestic

Cash and equivalents .................................... $ 577 $2,484

Cash posted as collateral ................................. 29 722

Credit card deposits in transit ............................. 137 117

Total domestic cash and cash equivalents ................... 743 3,323

Sears Canada .......................................... 879 516

Total cash and cash equivalents ........................... $1,622 $3,839

We had cash and cash equivalents of $1.6 billion at February 2, 2008 as compared to $3.8 billion at

February 3, 2007. The decline in cash and cash equivalents from February 3, 2007 primarily reflects share

repurchases made pursuant to our share repurchase program, as further discussed in the “Financing Activities and

Cash Flows” section below. During fiscal 2007, we repurchased 21.7 million common shares at a cost of $2.9

billion. Other significant uses of cash and cash equivalents for fiscal year ended February 2, 2008 included the

use of cash and cash equivalents to fund capital expenditures (approximately $580 million) and an approximate

$600 million decrease in borrowings, net of repayments, as further detailed in the “Financing Activities and Cash

Flows” section.

Our invested cash may include, from time to time, investments in, but not limited to, commercial paper,

U.S. federal, state and municipal government securities, floating-rate notes, repurchase agreements and money

market funds. Cash amounts held in these short-term investments are readily available to us and included

$20 million and $43 million as of fiscal year end 2007 and fiscal year end 2006, respectively, invested in support

of our wholly-owned insurance subsidiary. Additionally, as explained below, our Board of Directors has

delegated authority to direct investment of surplus cash to Edward S. Lampert, subject to various limitations that

have been or may be from time to time adopted by the Board of Directors and/or the Finance Committee of the

Board of Directors.

We have posted cash collateral for certain outstanding letters of credit and self-insurance programs. Such

cash collateral is classified within cash and cash equivalents as it is readily available to us and we have the ability

to substitute letters of credit at any time for this cash collateral.

Credit card deposits in transit include deposits in-transit from banks for payments related to third-party

credit card and debit card transactions.

We classify outstanding checks in excess of funds on deposit within other current liabilities and reduce cash

and cash equivalents when these checks clear the bank on which they were drawn. Outstanding checks in excess

of funds on deposit were $405 million and $353 million for the fiscal year ended 2007 and 2006, respectively.

40