Sears 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

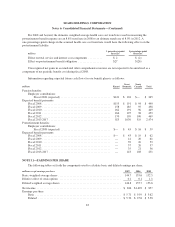

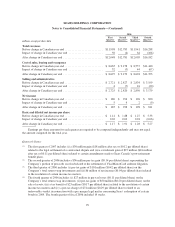

Minimum lease obligations, excluding taxes, insurance and other expenses payable directly by us, for leases

in effect as of February 2, 2008, were as follows:

millions

Minimum Lease

Commitments

Capital Operating

As of February 2, 2008

2008 .................................................... $ 143 $ 834

2009 .................................................... 135 751

2010 .................................................... 131 649

2011 .................................................... 126 566

2012 .................................................... 122 478

Later years ............................................... 668 3,654

Total minimum lease payments(1) ............................. 1,325 6,932

Less—minimum sublease income ............................. (315)

Net minimum lease payments ................................ $6,617

Less:

Estimated executory costs ............................... (165)

Interest at a weighted average rate of 7.9% .................. (411)

Capital lease obligations .................................... 749

Less current portion of capital lease obligations .................. (64)

Long-term capital lease obligations ............................ $ 685

(1) Sears Canada: Total operating minimum lease payments of $578 million.

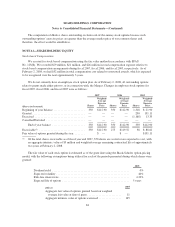

NOTE 17—RELATED PARTY DISCLOSURE

Our Board of Directors has delegated authority to direct investment of our surplus cash to Edward S.

Lampert, subject to various limitations that have been or may be from time to time adopted by the Board of

Directors and/or the Finance Committee of the Board of Directors. Mr. Lampert is Chairman of our Board of

Directors and Finance Committee and is the Chairman and Chief Executive Officer of ESL. Neither Mr. Lampert

nor ESL will receive compensation for any such investment activities undertaken on our behalf. ESL beneficially

owned 49.6% of our outstanding common stock as of February 2, 2008.

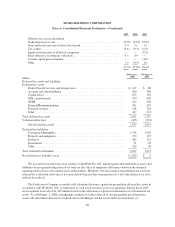

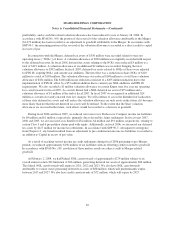

Further, to clarify the expectations that the Board of Directors has with respect to the investment of our

surplus cash, the Board has renounced, in accordance with Delaware law, any interest or expectancy of the

Company associated with any investment opportunities in securities that may come to the attention of

Mr. Lampert or any employee, officer, director or advisor to ESL and its affiliated investment entities who also

serves as an officer or director of the Company (each, a “Covered Party”) other than (a) investment opportunities

that come to such Covered Party’s attention directly and exclusively in such Covered Party’s capacity as a

director, officer or employee of the Company, (b) control investments in companies in the mass merchandising,

retailing, commercial appliance distribution, product protection agreements, residential and commercial product

installation and repair services and automotive repair and maintenance industries and (c) investment

opportunities in companies or assets with a significant role in our retailing business, including investment in real

estate currently leased by the Company or in suppliers for which the Company is a substantial customer

representing over 10% of such companies’ revenues, but excluding investments of ESL as of May 23, 2005.

92