Sears 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Our fiscal 2005 operating income reflects a pretax gain of $317 million from the sale of this business. The

sale, however, had no impact on Holdings’ net income. In applying purchase accounting for the Merger, the

Company, as 54% beneficial owner of Sears Canada at the time of the Merger, adjusted Sears Canada’s assets

and liabilities to fair value only to the extent of its proportionate share of ownership in these assets and liabilities.

The remaining portion of each asset and liability, representing the minority interest’s proportionate ownership,

was recorded at historical book value. Therefore, the excess of sales proceeds over the recorded values for Sears

Canada’s assets sold and liabilities transferred was attributable solely to the minority shareholder interests, as the

portion of proceeds allocable to our proportionate interest was equal to the Merger assigned fair value for such

assets and liabilities. Accordingly, the gain, solely allocable to the minority interest, was properly eliminated via

an increase in minority interest expense, resulting in no net gain to Holdings.

Sears Canada used a portion of the cash proceeds it generated from the sale to fund an extraordinary cash

dividend and a tax-free return of stated capital to shareholders of record on December 16, 2005. Holdings, as

beneficial owner of approximately 54% of the outstanding common stock of Sears Canada at the time of the

distribution, received an after-tax distribution of approximately $877 million.

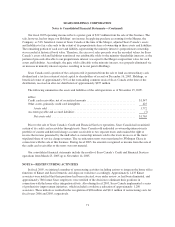

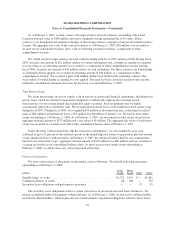

The following summarizes the assets and liabilities of the sold operations as of November 15, 2005.

millions

Credit card receivables, net of securitized amounts .................................. $1,347

Other assets, primarily credit card intangibles ...................................... 425

Assets sold ............................................................. 1,772

Accounts payable and accrued liabilities .......................................... (7)

Net assets sold .......................................................... $1,765

Prior to the sale of Sears Canada’s Credit and Financial Services operations, Sears Canada had securitized

certain of its credit card receivables through trusts. Sears Canada sold undivided co-ownership interests in its

portfolio of current and deferred charge accounts receivable to two separate trusts and retained the right to

receive the income generated by the undivided co-ownership interests sold to the trusts in excess of the trusts’

stipulated share of service charge revenues. The securitization trusts were transferred to JPMorgan Chase in

connection with the sale of this business. During fiscal 2005, the amounts recognized as income from the sale of

the credit card receivables to the trusts were not material.

Our consolidated financial statements include the results of Sears Canada’s Credit and Financial Services

operations from March 25, 2005 up to November 14, 2005.

NOTE 6—RESTRUCTURING ACTIVITIES

In fiscal 2005, we initiated a number of restructuring activities including actions to integrate the home office

functions of Kmart and Sears Domestic and align our workforce accordingly. Approximately 1,435 Kmart

associates were notified that their positions had been relocated, were under review, or had been eliminated, and

approximately 780 former Sears employees were notified of the decision to eliminate their positions in

connection with the home office integration efforts. Also during fiscal 2005, Sears Canada implemented a series

of productivity improvement initiatives, which included a workforce reduction of approximately 1,200

associates. These initiatives resulted in the recognition of $28 million and $111 million of restructuring costs for

fiscal years 2006 and 2005, respectively.

71