Sears 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

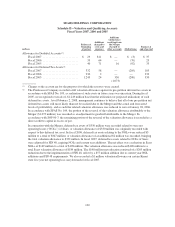

FIN 48 Accounting for Uncertainties in Income Taxes

Effective at the beginning of fiscal 2007, we adopted FIN 48, “Accounting for Uncertainties in Income

Taxes—an Interpretation of FASB Statement No. 109”. The impact upon adoption was to decrease retained

earnings by $6 million and to increase our accruals for uncertain tax positions by a corresponding amount. In

accordance with FIN 48, we increased goodwill and accruals for uncertain tax positions by $13 million to reflect

the measurement of uncertain tax positions associated with previous business acquisitions, and increased capital

in excess of par value and decreased accruals for uncertain tax positions by $2 million to reflect measurement of

an uncertain tax position related to Predecessor Company pre-petition income tax liabilities. In accordance with

AICPA Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy

Code,” resolutions of these matters results in a direct credit to capital in excess of par value within shareholders’

equity. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits (“UTB”) is as

follows:

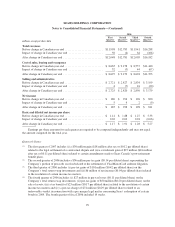

millions

Federal, State,

and Foreign

Tax

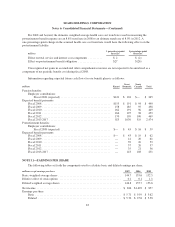

Gross UTB Balance at February 3, 2007 .............................. $408

Tax positions related to the current period:

Gross increases ............................................. 45

Gross decreases ............................................. (14)

Tax positions related to prior periods:

Gross increases ............................................. 98

Gross decreases ............................................. (21)

Settlements ................................................ (14)

Lapse of statute of limitations .................................. (48)

Gross UTB Balance at February 2, 2008 .............................. $454

At the end of fiscal 2007, we had gross unrecognized tax benefits of $454 million. Of this amount, $116

million would, if recognized, impact our effective tax rate, with the remaining amount being comprised of

unrecognized tax benefits related to gross temporary differences and prior business combinations or any other

indirect benefits. We expect that our unrecognized tax benefits could decrease up to $58 million over the next 12

months for state tax positions related to prior business dispositions due to both the expiration of the statute of

limitations for certain jurisdictions as well as expected settlements.

We classify interest expense and penalties related to unrecognized tax benefits and interest income on tax

overpayments as components of income tax expense. As of February 2, 2008, the total amount of interest and

penalties recognized on our consolidated balance sheet was $100 million. The total amount of interest and

penalties recognized in our consolidated statement of operations for fiscal 2007 was $5 million.

We file income tax returns in both the United States and various foreign jurisdictions. The Internal Revenue

Service (“IRS”) has commenced an audit of the Holdings’ federal income tax return for the fiscal year 2005 and

the Sears federal income tax returns for the fiscal years 2004 and 2005 through the date of the Merger. The IRS

has completed its examination of Sears’ federal income tax returns for the fiscal years 2002 and 2003, and we are

working with the IRS to resolve certain matters arising from this exam. In addition, Holdings and Sears are

subject to various state, local and foreign income tax examinations for the fiscal years 2001—2005 and Kmart is

subject to such examinations for the fiscal years 2003—2005.

90