Sears 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

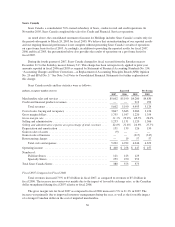

Sears Canada

Sears Canada, a consolidated, 70%-owned subsidiary of Sears, conducts retail and credit operations. In

November 2005, Sears Canada completed the sale of its Credit and Financial Services operations.

As noted above, the consolidated statement of income for Holdings includes Sears Canada’s results only for

the period subsequent to March 24, 2005 for fiscal 2005. We believe that an understanding of our reported results

and our ongoing financial performance is not complete without presenting Sears Canada’s results of operations

on a pro forma basis for fiscal 2005. Accordingly, in addition to providing the reported results for fiscal 2007,

2006 and fiscal 2005, the presentation below also provides the results of operations on a pro forma basis for

fiscal 2005.

During the fourth quarter of 2007, Sears Canada changed its fiscal year end from the Saturday nearest

December 31st to the Saturday nearest January 31st. This change has been retrospectively applied to prior year

amounts reported in fiscal 2006 and 2005 as required by Statement of Financial Accounting Standards No. 154,

“Accounting Changes and Error Corrections—A Replacement of Accounting Principles Board (APB) Opinion

No. 20 and SFAS No. 3.” See Note 3 of Notes to Consolidated Financial Statements for further explanation of

this change.

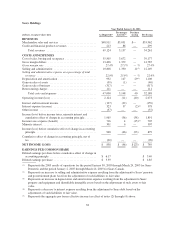

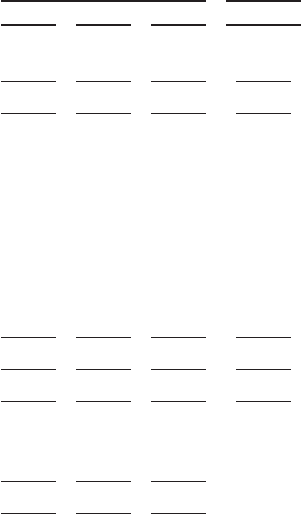

Sears Canada results and key statistics were as follows:

millions, except for number of stores Reported Pro Forma

2007 2006 2005 2005

Merchandise sales and services .................................. $5,602 $5,190 $4,280 $4,830

Credit and financial products revenues ............................ — — 213 299

Total revenues ........................................... 5,602 5,190 4,493 5,129

Cost of sales, buying and occupancy ............................. 3,847 3,643 3,060 3,476

Gross margin dollars .......................................... 1,755 1,547 1,220 1,354

Gross margin rate ............................................ 31.3% 29.8% 28.5% 28.0%

Selling and administrative ...................................... 1,233 1,131 1,120 1,306

Selling and administrative expense as a percentage of total revenues .... 22.0% 21.8% 24.9% 25.5%

Depreciation and amortization .................................. 131 139 126 150

Gain on sales of assets ......................................... (9) — — —

Gain on sale of business ....................................... — — (317) (317)

Restructuring charges ......................................... — 19 57 57

Total costs and expenses ................................... 5,202 4,932 4,046 4,672

Operating income ............................................ $ 400 $ 258 $ 447 $ 457

Number of:

Full-line Stores .......................................... 121 123 123

Specialty Stores .......................................... 259 250 252

Total Sears Canada Stores ...................................... 380 373 375

Fiscal 2007 Compared to Fiscal 2006

Total revenues increased 7.9% to $5.6 billion in fiscal 2007, as compared to revenues of $5.2 billion in

fiscal 2006. The increase in revenues was mainly due to the impact of favorable exchange rates, as the Canadian

dollar strengthened during fiscal 2007 relative to fiscal 2006.

The gross margin rate for fiscal 2007 as compared to fiscal 2006 increased 1.5% to 31.3% in 2007. The

increase was primarily due to improved inventory management during the year, as well as the favorable impact

of a stronger Canadian dollar on the cost of imported merchandise.

36