Sears 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

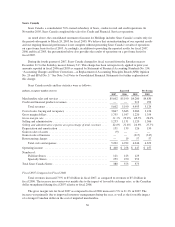

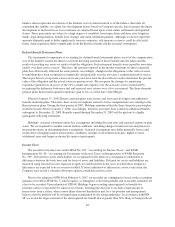

(6) Represents the 2005 results of operations for the period January 2, 2005 through January 28, 2006 for

Kmart, the period March 25, 2005 through January 28, 2006 for Sears Domestic and the period from

March 25, 2005 through December 31, 2005 for Sears Canada. Results of Sears Canada for the period

March 25, 2005 through December 31, 2005 have not been updated to reflect the impact of its change in

year end, which occurred during the fourth quarter of fiscal 2007.

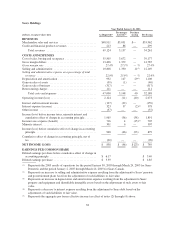

Sears Domestic

Year Ended January 28, 2006

millions As Reported

Pre-merger

Activity(1)

Purchase

Acctng Pro Forma

Merchandise sales and services ........................... $25,868 $4,170 $— $30,038

Cost of sales, buying and occupancy ....................... 18,221 3,018 — 21,239

Gross margin dollars .................................... 7,647 1,152 — 8,799

Gross margin rate ...................................... 29.6% 27.6% — % 29.3%

Selling and administrative ............................... 5,968 1,060 11(2) 7,039

Selling and administrative expense as a percentage of total

revenues ........................................... 23.1% 25.4% — % 23.4%

Depreciation and amortization ............................ 769 116 26

(3) 911

Loss (gain) on sales of assets ............................. 1 (1) — —

Total costs and expenses ............................. 24,959 4,193 37 29,189

Operating income (loss) ................................. $ 909 $ (23) $ (37) $ 849

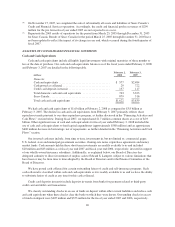

Sears Canada

Year Ended January 28, 2006

millions As Reported(5)

Pre-merger

Activity(1)

Purchase

Acctng Pro Forma

Merchandise sales and services .......................... $3,949 $ 881 $— $4,830

Credit and financial products revenues(4) ................... 213 86 — 299

Total revenues ................................... 4,162 967 — 5,129

Cost of sales, buying and occupancy ...................... 2,822 654 — 3,476

Gross margin dollars .................................. 1,127 227 — 1,354

Gross margin rate .................................... 28.5% 25.8% — % 28.0%

Selling and administrative .............................. 1,036 270 — 1,306

Selling and administrative expense as a percentage of total

revenues .......................................... 24.9% 27.9% — % 25.5%

Depreciation and amortization ........................... 116 31 3

(3) 150

Gain on sale of business ................................ (317) — — (317)

Restructuring charges .................................. 57 — — 57

Total costs and expenses ........................... 3,714 955 3 4,672

Operating income (loss) ................................ $ 448 $ 12 $ (3) $ 457

(1) Represents the 2005 results of operations for the period January 30, 2005 through March 24, 2005 for Sears

Domestic and the period January 2, 2005 through March 24, 2005 for Sears Canada.

(2) Represents an increase to selling and administrative expense resulting from the adjustment to Sears’ pension

and postretirement plans based on the adjustment of such liabilities to fair value.

(3) Represents an increase in depreciation and amortization expense resulting from the adjustment to Sears’

property and equipment and identifiable intangible assets based on the adjustment of such assets to fair

value.

39