Sears 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

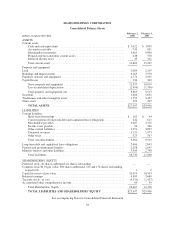

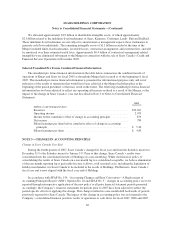

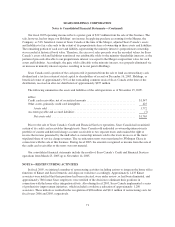

Changes in the carrying amount of goodwill by segment during fiscal years 2006 and 2007 are as follows:

Sears

Domestic

Sears

Canada Total

millions

Balance, January 28, 2006 .............................................. $1,585 $ 99 $1,684

Finalization of purchase accounting(1) ................................. 37 — 37

Acquisition of additional interest in Sears Canada ........................ — 167 167

Tax settlements affecting Merger-related goodwill ....................... (188) (8) (196)

Balance, February 3, 2007 .............................................. $1,434 $258 $1,692

Tax adjustments and other items affecting Merger-related goodwill .......... (6) — (6)

Balance, February 2, 2008 .............................................. $1,428 $258 $1,686

(1) We completed the purchase price allocation for the Merger during the first quarter of fiscal 2006. As a

result, goodwill attributable to the Merger increased by approximately $37 million, primarily based on the

receipt of additional information regarding the fair values of certain properties and certain pre-Merger legal

contingencies.

As the result of reaching various tax audit settlements during fiscal 2006 pertaining to pre-Merger periods,

we reduced approximately $196 million of tax liabilities with an offsetting credit recorded to goodwill. In

accordance with SFAS No. 109, “Accounting for Income Taxes,” resolution of these matters results in a direct

credit to Merger-related goodwill.

In accordance with SFAS No. 142, “Goodwill and Other Intangible Assets,” goodwill is not amortized but

requires testing for potential impairment, at a minimum on an annual basis, or when indications of potential

impairment exist. The impairment test for goodwill utilizes a fair value approach. The impairment test for

identifiable intangible assets not subject to amortization is also performed annually or when impairment

indications exist, and consists of a comparison of the fair value of the intangible asset with its carrying amount.

Identifiable intangible assets that are subject to amortization are evaluated for impairment using a process similar

to that used to evaluate other long-lived assets. Our impairment analysis is performed as of the last day of our

November accounting period each year.

Financial Instruments and Hedging Activities

From time to time, we use derivative financial instruments, including interest rate swaps and caps to manage

our exposure to movements in interest rates, and foreign currency forward contracts to hedge the foreign

currency exposure of our net investment in Sears Canada against adverse changes in exchange rates. In addition,

we entered into total return swaps during fiscal 2007 and 2006 as a means for investing a portion of our surplus

cash. We recognize all derivative instruments at fair value within either other assets or other liabilities on our

consolidated balance sheet.

When applying hedge accounting treatment to our derivative transactions, we formally document our hedge

relationships, including identification of the hedging instruments and the hedged items, as well as our risk

management objectives and strategies for undertaking the hedge transaction. We also formally assesses, both at

inception and at least quarterly thereafter, whether the derivatives that are used in hedging transactions are highly

effective in offsetting changes in either the fair value or cash flows of the hedged item. If it is determined that a

derivative ceases to be a highly effective hedge, we discontinue hedge accounting.

62