Sears 2007 Annual Report Download - page 32

Download and view the complete annual report

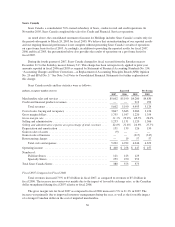

Please find page 32 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.categories, most notably in the apparel and home categories. Increased markdowns had a negative impact on our

margins in these categories as we made efforts to clear seasonal apparel, as well as lawn and garden and other

home products affected by the slowdown in the housing market.

For fiscal 2007, Kmart’s selling and administrative expense rate was 20.5%, as compared to 19.4% for fiscal

2006. Fiscal 2006 selling and administrative expenses included a $19 million gain, representing Kmart’s portion

of the settlement in the Visa/MasterCard antitrust litigation. Excluding this gain, Kmart’s selling and

administrative expense rate was 19.5% for fiscal 2006. While total selling and administrative expenses declined

$86 million in fiscal 2007, mainly as the result of reduced payroll and benefits expense including lower

performance-based compensation, the current year selling and administrative rate increased, reflecting lower

expense leverage against sales for this fiscal year.

Kmart recorded $1 million and $71 million in gains on sales of assets during fiscal 2007 and fiscal 2006,

respectively. Gains recorded on sales of assets in fiscal 2006 included a $41 million pre-tax gain recognized in

connection with our 2005 sale of Kmart’s former corporate headquarters in Troy, Michigan.

Kmart recorded restructuring charges of $9 million during fiscal 2006. The charges were for relocation

assistance and employee termination-related costs incurred in connection with Holdings’ home office integration

efforts initiated in fiscal 2005. No such charges were recorded in fiscal 2007.

Operating income was $402 million in fiscal year 2007, as compared to operating income of $948 million in

fiscal 2006, a decline of $546 million. As discussed above, declines primarily reflect the negative gross margin

impact of lower sales levels, as well as a decline in Kmart’s gross margin rate in 2007. In addition to the above-

noted decline in gross margin, the decline reflects, to a lesser degree, the impact of higher depreciation and

amortization expense, and lower gains on sales of assets in fiscal 2007, partially offset by the favorable impact of

lower selling and administrative expenses and a decrease in restructuring costs.

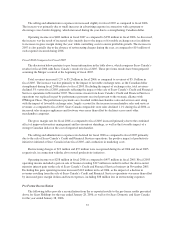

Fiscal 2006 Compared to Fiscal 2005

Comparable store sales and total sales decreased 0.6% and 2.3%, respectively, during fiscal 2006. The 0.6%

decline in Kmart comparable store sales during fiscal 2006 compares to a 1.2% decline in comparable store sales

recorded for fiscal 2005. The fiscal 2006 decline in comparable store sales reflected the continued impact of increased

competition and lower transaction volumes recorded across most businesses. Comparable store apparel sales increased

for a second straight year during fiscal 2006, but as was the case in fiscal 2005, this improvement was more than offset

by comparable store sales declines across most other Kmart merchandise categories. Total sales in fiscal 2006

benefited from $301 million in sales recorded during the 53rd week of the 53-week fiscal year, partially offset by the

fact that $153 million of sales were recorded during the first quarter of fiscal 2005 as a result of three additional days

being included in fiscal 2005 due to our change from a Wednesday to a Saturday month end that year. However, the

net favorable impact on fiscal 2006 sales derived from these items (approximately 0.8%) was more than offset by the

negative impact of a reduction in the total number of Kmart stores in operation during fiscal 2006, as compared to

fiscal 2005. Store closures and conversions accounted for an approximate 2.4% decline in total Kmart sales for fiscal

2006, as fiscal 2005 total sales benefited from sales generated at stores subsequently closed in fiscal 2006, as well as

partial-year sales recorded in stores closed during fiscal 2005. A net total of 28 Kmart stores were closed during fiscal

2006, including 16 Kmart stores converted to a Sears Essentials/Grand format. The remaining balance of the decline in

total sales for fiscal 2006, as compared to fiscal 2005, was due to the above-noted decline in comparable store sales.

The gross margin rate was 24.6% in fiscal 2006, as compared to 24.3% for fiscal 2005. The improvement

reflected better margin management across a number of businesses, most notably within apparel, where an

increased use of direct-sourced merchandise obtained at a lower cost to us, as well as enhanced profitability of

promotional activity improved gross margin.

The selling and administrative expense rate was 19.4% for fiscal 2006, as compared to 19.9% for fiscal

2005. Fiscal 2006 selling and administrative expenses included a $19 million gain, representing Kmart’s portion

32