Sears 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

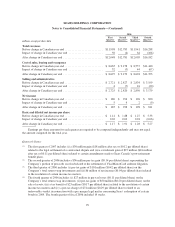

Notes to Consolidated Financial Statements—(Continued)

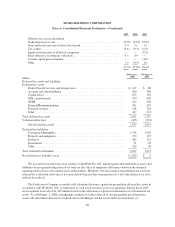

profitability, and as such the related valuation allowance has been reduced to zero at January 28, 2006. In

accordance with SFAS No. 109, the portion of the reversal of the valuation allowance attributable to the Merger

($1,073 million) has been recorded as an adjustment to goodwill attributable to the Merger. In accordance with

SOP 90-7, the remaining portion of the reversal of the valuation allowance is recorded as a direct credit to capital

in excess of par.

In connection with the Merger, deferred tax assets of $350 million were recorded related to state net

operating losses (“NOLs”) of Sears. A valuation allowance of $330 million was originally recorded with respect

to this deferred tax asset. In fiscal 2006, deferred tax assets relating to the NOLs were reduced $3 million to a

total of $347 million. A valuation allowance of an additional $2 million was recorded, bringing the total

valuation allowance to $332 million. In fiscal 2007, deferred tax assets related to NOLs of Sears were adjusted

for FIN 48, expiring NOLs and current year additions. The net effect was a reduction in Sears NOLs of $149

million to a total of $198 million. The valuation allowance was reduced $148 million to a total Sears valuation

allowance of $184 million. The $148 million net reduction consisted of a $205 million reduction due to the

implementation of FIN 48, offset by a $57 million addition due to current year NOL additions and FIN 48

requirements. We also recorded a $1 million valuation allowance on certain Kmart state five year net operating

loss carryforwards for fiscal 2007. As a result, Kmart had a NOL deferred tax asset of $75 million and a

valuation allowance of $1 million at the end of fiscal 2007. In fiscal 2007 we recognized an additional $24

million as a result of recently enacted state law changes. We will continue to assess the likelihood of realization

of these state deferred tax assets and will reduce the valuation allowance on such assets in the future if it becomes

more likely than not that the net deferred tax assets will be utilized. To the extent that the Sears valuation

allowances are reversed in the future, such effects would be recorded as a decrease to goodwill.

During fiscal 2006 and fiscal 2005, we reduced our reserves for Predecessor Company income tax liabilities

by $4 million and $1 million, respectively, primarily due to favorable claims settlements. In fiscal years 2007,

2006 and 2005, we also received a tax benefit of $32 million, $4 million and $91 million, respectively, relating to

certain Class 5 and 6 pre-petition claims paid with equity. Additionally, in fiscal 2006, we increased our deferred

tax assets by $127 million for income tax settlements. In accordance with SOP 90-7, subsequent to emergence

from Chapter 11, any benefit realized from an adjustment to pre-confirmation income tax liabilities is recorded as

an addition to Capital in excess of par value.

As a result of reaching various income tax audit settlements during fiscal 2006 pertaining to pre-Merger

periods, we reduced approximately $196 million of tax liabilities with an offsetting credit recorded to goodwill.

In accordance with SFAS No. 109, resolution of these matters results in a direct credit to Merger-related

goodwill.

At February 2, 2008, we had Federal NOL carryforwards of approximately $274 million subject to an

overall annual section 382 limitation of $96 million, generating deferred tax assets of approximately $96 million.

The federal NOL carryforwards will expire in 2021, 2022 and 2023. We also have NOL carryforwards

attributable to various states generating deferred tax assets of $88 million, which will predominantly expire

between 2017 and 2027. We also have credit carryforwards of $72 million, which will expire by 2027.

89