Sears 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

We allocated approximately $3.9 billion to identifiable intangible assets, of which approximately

$2.8 billion related to the indefinite-lived tradenames of Sears, Kenmore, Craftsman, Lands’ End and DieHard.

These indefinite-lived tradenames are not subject to amortization as management expects these tradenames to

generate cash flows indefinitely. The remaining intangible assets of $1.1 billion recorded at the time of the

Merger included finite-lived tradenames, favorable leases, contractual arrangements and customer lists, and will

be amortized over their estimated useful lives. Approximately $0.4 billion of contractual-arrangement-related

intangibles were eliminated subsequent to the Merger in connection with the sale of Sears Canada’s Credit and

Financial Services Operations in November 2005.

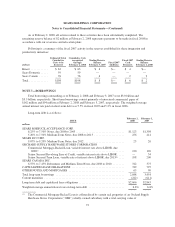

Selected Unaudited Pro Forma Combined Financial Information

The unaudited pro forma financial information in the table below summarizes the combined results of

operations of Kmart and Sears for fiscal 2005 as though the Merger had occurred as of the beginning of fiscal

2005. The unaudited pro forma financial information is presented for informational purposes only and is not

indicative of the results of operations that would have been achieved if the Merger had taken place at the

beginning of the period presented, or that may result in the future. The following unaudited pro forma financial

information has not been adjusted to reflect any operating efficiencies realized as a result of the Merger, or the

impact of the change in Sears Canada’s year end described in Note 3 of Notes to Consolidated Financial

Statements.

2005

millions, except earnings per share

Revenues ......................................................... $54,261

Operating income ................................................... 2,073

Income before cumulative effect of change in accounting principle ............ 879

Net income ........................................................ 789

Diluted earnings per share before cumulative effect of change in accounting

principle ........................................................ $ 5.40

Diluted earnings per share ............................................ $ 4.85

NOTE 3—CHANGES IN ACCOUNTING PRINCIPLE

Change in Sears Canada Year End

During the fourth quarter of 2007, Sears Canada’s changed its fiscal year end from the Saturday nearest to

December 31st to the Saturday nearest to January 31st. Prior to this change, Sears Canada’s results were

consolidated into the consolidated results of Holdings on a one-month lag. While our historical policy of

consolidating the results of Sears Canada on a one-month lag was considered acceptable, we believe elimination

of the one-month reporting lag is preferable because it allows a full seasonal cycle, including the liquidation of

holiday merchandise, for Sears Canada to be included in the results of Holdings. Furthermore, Sears Canada’s

fiscal year end is now aligned with the fiscal year end of Holdings.

In accordance with SFAS No. 154, “Accounting Changes and Error Corrections—A Replacement of

Accounting Principles Board (“APB”) Opinion No. 20 and SFAS No. 3”, changes in accounting policy are to be

reported through retrospective application of the new policy to all prior financial statement periods presented.

Accordingly, the Company’s financial statements for periods prior to 2007 have been adjusted to reflect the

period-specific effects of applying this change. This change resulted in a one-month shift backwards of periods

previously reported for Sears Canada. The impact of this change in accounting policy was not material to the

Company’s consolidated financial position, results of operations or cash flows for fiscal 2007, 2006 and 2005.

69