Sears 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Improved Operating Cash Flow

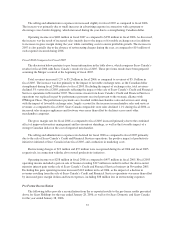

Although fiscal 2007 presented significant challenges, we generated approximately $1.5 billion in cash from

operations during the year, which represents a $119 million increase over fiscal 2006. The improvement in our

cash flow resulted mainly from our management of inventory during the year, as compared to 2006, even though

net income decreased in fiscal 2007.

Reduction in Debt Assumed as Part of the Merger

Total outstanding debt and capital leases were reduced during the year by $601 million, which represents a

decrease of about 17% in our debt levels from the end of fiscal 2006. This debt was primarily Sears’ debt

included in Holdings’ consolidated balance sheet subsequent to the Merger.

Share Repurchases

We repurchased approximately 21.7 million of our common shares in fiscal 2007 at a total cost of

approximately $2.9 billion under our common share repurchase program described under the “Financing

Activities and Cash Flows” section below.

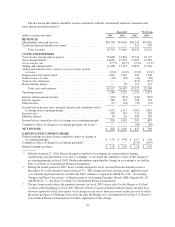

Holdings’ Consolidated Results

Fiscal 2007 Compared to Fiscal 2006

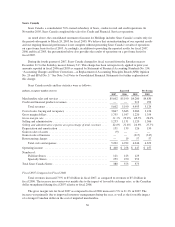

Fiscal 2007 revenues were $50.7 billion as compared to $53.0 billion in fiscal 2006. As discussed above, the

decrease in fiscal 2007 revenues, as compared to reported revenues for fiscal 2006, was primarily due to the

above-noted impact of lower domestic comparable store sales, and to a lesser degree, the inclusion of an

additional week of sales in fiscal 2006 (comprised of 53 weeks) as compared to fiscal 2007 (comprised of 52

weeks). We recorded a total of $711 million in revenues during the 53rd week of fiscal 2006. Theses declines

were partially offset by sales increases at Sears Canada, primarily reflecting the impact of favorable exchange

rates, as the Canadian dollar strengthened in fiscal 2007.

The gross margin rate was 27.7% in fiscal 2007, as compared to 28.7% in fiscal 2006. Gross margin rate

declines at Kmart and Sears Domestic were partially offset by an increase in the rate at Sears Canada. As

discussed previously, the decrease in margin rate relates to markdowns taken to clear excess levels of inventory,

as well as reduced leverage of buying and occupancy costs, given lower overall sales levels in fiscal 2007.

The selling and administrative expense rate was 22.6% in fiscal 2007, as compared to 21.8% for fiscal 2006.

As noted above, total selling and administrative expenses declined $106 million in fiscal 2007, mainly as the

result of reduced payroll and benefits expense including lower performance-based compensation. However, the

current year selling and administrative rate increased, primarily reflecting lower expense leverage resulting from

lower overall sales levels.

Depreciation and amortization was $1.0 billion for fiscal 2007, as compared to $1.1 billion for fiscal 2006.

The decreased expense for fiscal 2007 is primarily attributable to additional property and equipment becoming

fully depreciated during the year, thereby decreasing our depreciable asset base.

Gains on sales of assets were $38 million in fiscal 2007, as compared to $82 million for fiscal 2006. The

fiscal 2006 gain was primarily attributable to a $41 million pre-tax gain recognized in connection with the 2005

sale of our former Kmart headquarters in Troy, Michigan.

Restructuring charges were $28 million for fiscal 2006. These charges included $19 million for

employee-related termination costs associated with Sears Canada’s restructuring initiatives implemented during

fiscal 2005, including a workforce reduction of approximately 1,200 associates, as well as $9 million at Kmart

28