Sears 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

The computation of dilutive shares outstanding excludes out-of-the-money stock options because such

outstanding options’ exercise prices are greater than the average market price of our common shares and,

therefore, the effect would be antidilutive.

NOTE 12—SHAREHOLDERS’ EQUITY

Stock-based Compensation

We account for stock-based compensation using the fair value method in accordance with SFAS

No. 123(R). We recorded $29 million, $21 million, and $26 million in total compensation expense relative to

stock-based compensation arrangements during fiscal 2007, fiscal 2006, and fiscal 2005, respectively. As of

February 2, 2008, we had $52 million in total compensation cost related to nonvested awards, which is expected

to be recognized over the next approximately 3 years.

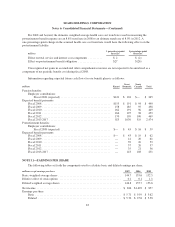

We do not currently have an employee stock option plan. As of February 2, 2008, all outstanding options

relate to grants made either prior to, or in connection with, the Merger. Changes in employee stock options for

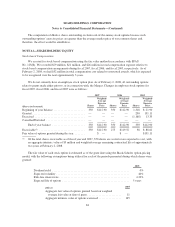

fiscal 2007, fiscal 2006, and fiscal 2005 were as follows:

(Shares in thousands)

2007 2006 2005

Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price Shares

Weighted-

Average

Exercise

Price

Beginning of year balance ...................... 350 $112.90 350 $112.90 1,318 $ 21.90

Granted ..................................... — — — — 200 131.11

Exercised ................................... — — — — (1,168) 13.33

Cancelled/Forfeited ........................... — — — — — —

End of year balance ....................... 350 $112.90 350 $112.90 350 $112.90

Exercisable(1) ................................ 350 $112.90 275 $119.52 38 $ 88.62

Fair value of options granted during the year ....... $ — $ — $131.11

(1) Of the total shares exercisable as of fiscal year end 2007, 350 shares are vested or are expected to vest, with

an aggregate intrinsic value of $3 million and weighted-average remaining contractual life of approximately

two years at February 2, 2008.

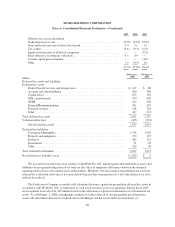

The fair value of each stock option is estimated as of the grant date using the Black-Scholes option-pricing

model, with the following assumptions being utilized for each of the periods presented during which shares were

granted:

2005

Dividend yield ...................................................... 0%

Expected volatility ................................................... 40%

Risk-free interest rate ................................................. 4.22%

Expected life of options ............................................... 5years

millions 2005

Aggregate fair value of options granted based on weighted

average fair value at date of grant ........................ 11

Aggregate intrinsic value of options exercised ................ 145

84