Sears 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Holdings employs certain employees of ESL. William C. Crowley is a director and our Executive Vice

President, Chief Administrative Officer while continuing his role as President and Chief Operating Officer of

ESL. Our Senior Vice President of Real Estate is also employed by ESL.

On January 18, 2007, Sears made a payment to plaintiffs in the case of In re: Sears, Roebuck and Co.

Securities Litigation of approximately $215 million pursuant to the terms of a settlement dated September 14,

2006. Certain affiliates of ESL owned shares of common stock of Sears before, during and after the class period

and were included in the class certified by the Court. Accordingly, these affiliates of ESL received their

proportionate share of the net settlement proceeds (approximately $12.9 million) in connection with the

settlement.

As discussed in Note 7, on January 31, 2005, ESL affiliates converted, in accordance with their terms, the

outstanding Notes and six months of accrued interest into an aggregate of 6.3 million shares of Kmart common

stock. In consideration of the conversion of these Notes prior to maturity, ESL affiliates received a $3 million

payment from Kmart. The cash payment was equivalent to the approximate discounted, after-tax cost of the

future interest payments that would have otherwise been paid by Kmart to the ESL affiliates in the absence of the

early conversion.

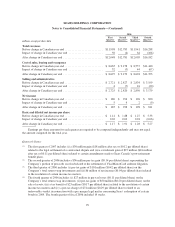

NOTE 18—SUPPLEMENTAL FINANCIAL INFORMATION

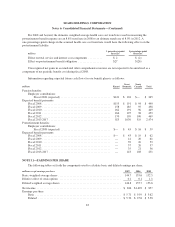

Other current liabilities as of February 2, 2008 and February 3, 2007 consisted of the following:

millions

February 2,

2008

February 3,

2007

Payroll and benefits payable .............................. $ 367 $ 533

Outstanding checks in excess of funds on deposit ............. 405 353

Current portion of self-insurance reserves ................... 377 370

Accrued expenses ...................................... 930 896

Other ................................................ 1,892 1,743

Total ............................................ $3,971 $3,895

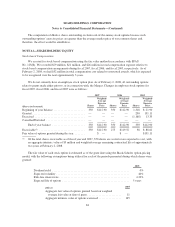

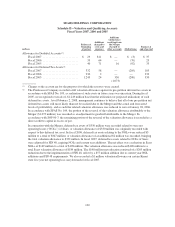

Minority interest and other liabilities as of February 2, 2008 and February 3, 2007 consisted of the

following:

millions

February 2,

2008

February 3,

2007

Unearned revenues ..................................... $ 945 $ 928

Self-insurance reserves .................................. 802 772

Minority interest ....................................... 313 166

Other ................................................ 1,244 932

Total ............................................ $3,304 $2,798

93