Sears 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

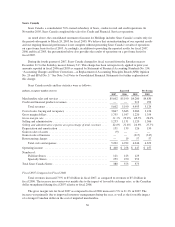

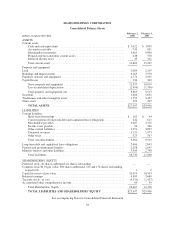

Contractual Obligations and Off-Balance Sheet Arrangements

Information concerning our obligations and commitments to make future payments under contracts such as

debt and lease agreements, and under contingent commitments, is aggregated in the following tables.

Payments Due by Period

Contractual Obligations Total

Within

1 Year

1-3

Years

4-5

Years

After 5

Years Other

millions

Operating leases ................................. $ 6,932 $ 834 $1,400 $1,044 $3,654 $—

Short-term debt ................................. 162 162 — — — —

Capital lease obligations .......................... 1,325 143 266 248 668 —

Royalty license fees(1) ............................ 191 143 46 2 — —

Purchase obligations ............................. 77 25 26 26 — —

Pension funding obligations ........................ 959 245 375 339 — —

Long-term debt .................................. 3,544 599 970 604 1,371 —

FIN 48 liability and interest(2) ...................... 337 ————337

Total contractual obligations ....................... $13,527 $2,151 $3,083 $2,263 $5,693 $337

(1) We pay royalties under various merchandise license agreements, which are generally based on sales of

products covered under these agreements. We currently have license agreements for which we pay royalties,

including those to use the Jaclyn Smith, Joe Boxer, and Martha Stewart Everyday trademarks. Royalty

license fees represent the minimum Holdings is obligated to pay, regardless of sales, as guaranteed royalties

under these license agreements.

(2) As of February 2, 2008, our FIN 48 liability and FIN 48 gross interest payable were $237 million and $100

million, respectively. We are unable to reasonably estimate the timing of FIN 48 liability and interest

payments in individual years beyond 12 months due to the uncertainties in the timing of the effective

settlement of tax positions.

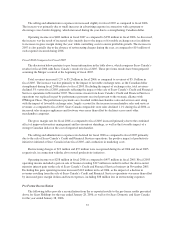

Other Commercial Commitments

millions

Bank

Issued

SRAC

Issued Other Total

Standby letters of credit ............................................ $1,722 $119 $— $1,841

Commercial letters of credit ........................................ 66 104 — 170

Secondary lease obligations and performance guarantee .................. — — 55 55

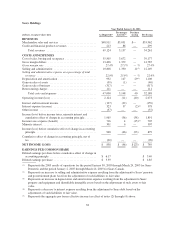

Application of Critical Accounting Policies

In preparing the financial statements, certain accounting policies require considerable judgment to select the

appropriate assumptions to calculate financial estimates. These estimates are complex and subject to an inherent

degree of uncertainty. We base our estimates on historical experience, terms of existing contracts, evaluation of

trends and other assumptions that we believe to be reasonable under the circumstances. We continually evaluate

the information used to make these estimates as our business and the economic environment change. Although

the use of estimates is pervasive throughout the financial statements, we consider an accounting estimate to be

critical if:

• it requires assumptions to be made about matters that were highly uncertain at the time the estimate

was made, and

• changes in the estimate that are reasonably likely to occur from period to period or different estimates

that could have been selected would have a material effect on our financial condition, cash flows or

results of operations.

46