Sears 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

We have divided our “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” (“MD&A”) into the following five sections:

• Overview of Holdings and Fiscal Year

• Results of Operations:

Fiscal 2007 Summary

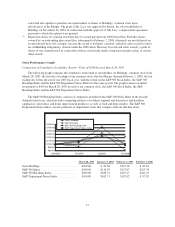

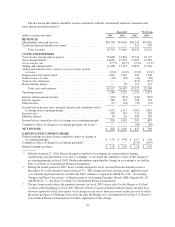

Holdings’ Consolidated Results

Business Segment Results

Pro Forma Reconciliation

• Analysis of Consolidated Financial Condition

• Contractual Obligations and Off-Balance Sheet Arrangements

• Application of Critical Accounting Policies

Overview of Holdings

Holdings, the parent company of Kmart and Sears, was formed in connection with the March 24, 2005

Merger of these two companies. We are a broadline retailer and, at the end of fiscal 2007, had 2,317 Kmart and

domestic full-line stores and 1,150 specialty retail stores in the United States operating through Kmart and Sears

and 380 full-line and specialty retail stores in Canada operating through Sears Canada, a 70%-owned subsidiary.

We currently conduct our operations in three business segments: Kmart, Sears Domestic and Sears Canada.

Prior to the Merger, we operated a single business segment, Kmart. The nature of operations conducted within

each of these segments is discussed within the “Business Segments” section of Item 1 in this Form 10-K.

The retail industry is highly competitive and as such, Holdings faces significant challenges to achieve

prominence. However, we believe that we posses unique resources with which we can differentiate ourselves

from our competitors. These resources include:

• The brands we own (Kenmore, Craftsman, DieHard, and Lands’ End) are one of our most important

resources. We believe that each of these four brands has significant recognition and value with

customers.

•Home services, including installation, delivery, and repair, represent another important resource of our

Company. Our extensive network of in-home and in-store service businesses gives us the opportunity

to retain long-term relationships with our customers—a chance to deliver value not only at the point of

sale but also on an ongoing basis, and a chance to learn continuously about our customers and what

they like and do not like about our products.

• Our existing store base is another resource, as our more than 3,400 domestic stores provide us with a

physical presence in almost all major communities in the United States.

• We also have viable on-line businesses, which enhance our multi-channel customer experience.

Sears.com, Landsend.com and PartsDirect.com are examples of on-line channels where we engage and

transact with our customers. We are investing in these on-line capabilities, as we believe that a

compelling multi-channel experience will be an important factor for success in the years and decades to

come.

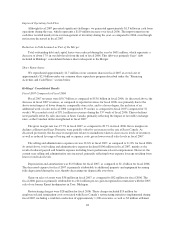

In addition to these resources, we believe that we have a solid balance sheet, with capacity to secure additional

debt if necessary. We own substantial inventory and real estate assets, and have also reduced our consolidated

debt to $2.3 billion ($3.0 billion with capital leases), which we consider low in relation to both our cash flow

generation and market capitalization.

21